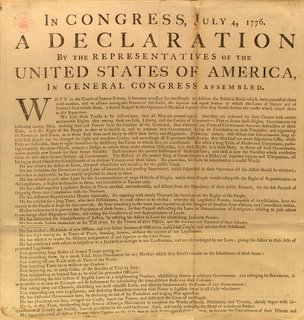

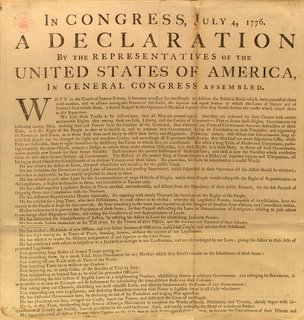

"But when a long Train of Abuses and Usurpations, pursuing invariably the same Object, evinces a Design to reduce them under absolute Despotism, it is their Right, it is their Duty, to throw off such Government, and to provide new Guards for their future Security."

"But when a long Train of Abuses and Usurpations, pursuing invariably the same Object, evinces a Design to reduce them under absolute Despotism, it is their Right, it is their Duty, to throw off such Government, and to provide new Guards for their future Security." The Declaration of Independence

"We the People of the United States, in Order to form a more perfect Union, establish Justice, insure domestic Tranquility, provide for the common defence, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity, do ordain and establish this Constitution for the United States of America..."

"We the People of the United States, in Order to form a more perfect Union, establish Justice, insure domestic Tranquility, provide for the common defence, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity, do ordain and establish this Constitution for the United States of America..." The Constitution of the United States of America

'Tis folly in one Nation to look for disinterested favors from another; that it must pay with a portion of its Independence for whatever it may accept under that character; that by such acceptance, it may place itself in the condition of having given equivalents for nominal favours and yet of being reproached with ingratitude for not giving more. There can be no greater error than to expect, or calculate upon real favours from Nation to Nation. 'Tis an illusion which experience must cure, which a just pride ought to discard. George Washington, Farewell Address, September 19, 1796

A people... who are possessed of the spirit of commerce, who see and who will pursue their advantages may achieve almost anything.

George Washington, letter to Benjamin Harrison, October 10, 1784

Harmony, liberal intercourse with all Nations, are recommended by policy, humanity and interest. But even our Commercial policy should hold an equal and impartial hand: neither seeking nor granting exclusive favours or preferences; consulting the natural course of things; diffusing and diversifying by gentle means the streams of Commerce, but forcing nothing; establishing with Powers so disposed; in order to give trade a stable course. George Washington, Farewell Address, September 19, 1796

In proportion as the structure of a government gives force to public opinion, it is essential that public opinion should be enlightened. George Washington, Farewell Address, September 19, 1796

Knowledge is, in every country, the surest basis of public happiness. George Washington, First Annual Message, January 8, 1790

No taxes can be devised which are not more or less inconvenient and unpleasant. George Washington, Farewell Address, September 19, 1796

Observe good faith and justice towards all Nations. Cultivate peace and harmony with all. George Washington, Farewell Address, September 19, 1796

The value of liberty was thus enhanced in our estimation by the difficulty of its attainment, and the worth of characters appreciated by the trial of adversity. George Washington, letter to the people of South Carolina, Circa 1790

There exists in the economy and course of nature, an indissoluble union between virtue and happiness; between duty and advantage; between the genuine maxims of an honest and magnanimous policy, and the solid rewards of public prosperity and felicity; since we ought to be no less persuaded that the propitious smiles of Heaven can never be expected on a nation that disregards the eternal rules of order and right, which Heaven itself has ordained. George Washington, First Inaugural Address, April 30, 1789

Tis substantially true, that virtue or morality is a necessary spring of popular government. The rule indeed extends with more or less force to every species of free Government. George Washington, Farewell Address, September 19, 1796

Human nature itself is evermore an advocate for liberty. There is also in human nature a resentment of injury, and indignation against wrong. A love of truth and a veneration of virtue. These amiable passions, are the "latent spark"... If the people are capable of understanding, seeing and feeling the differences between true and false, right and wrong, virtue and vice, to what better principle can the friends of mankind apply than to the sense of this difference? John Adams, the Novanglus, 1775

Government is instituted for the common good; for the protection, safety, prosperity, and happiness of the people; and not for profit, honor, or private interest of any one man, family, or class of men; therefore, the people alone have an incontestable, unalienable, and indefeasible right to institute government; and to reform, alter, or totally change the same, when their protection, safety, prosperity, and happiness require it. John Adams, Thoughts on Government, 1776

Each individual of the society has a right to be protected by it in the enjoyment of his life, liberty, and property, according to standing laws. He is obliged, consequently, to contribute his share to the expense of this protection; and to give his personal service, or an equivalent, when necessary. But no part of the property of any individual can, with justice, be taken from him, or applied to public uses, without his own consent, or that of the representative body of the people. In fine, the people of this commonwealth are not controllable by any other laws than those to which their constitutional representative body have given their consent. John Adams, Thoughts on Government, 1776

Children should be educated and instructed in the principles of freedom. John Adams, Defense of the Constitutions, 1787

But a Constitution of Government once changed from Freedom, can never be restored. Liberty, once lost, is lost forever. John Adams, letter to Abigail Adams, July 17, 1775

As long as Property exists, it will accumulate in Individuals and Families. As long as Marriage exists, Knowledge, Property and Influence will accumulate in Families. John Adams, letter to Thomas Jefferson, July 16, 1814

A constitution founded on these principles introduces knowledge among the people, and inspires them with a conscious dignity becoming freemen; a general emulation takes place, which causes good humor, sociability, good manners, and good morals to be general. That elevation of sentiment inspired by such a government, makes the common people brave and enterprising. That ambition which is inspired by it makes them sober, industrious, and frugal. John Adams, Thoughts on Government, 1776

As good government is an empire of laws, how shall your laws be made? In a large society, inhabiting an extensive country, it is impossible that the whole should assemble to make laws. The first necessary step, then, is to depute power from the many to a few of the most wise and good. John Adams, Thoughts on Government, 1776

Wisdom and knowledge, as well as virtue, diffused generally among the body of the people, being necessary for the preservation of their rights and liberties, and as these depend on spreading the opportunities and advantages of education in the various parts of the country, and among the different orders of people, it shall be the duty of legislators and magistrates... to cherish the interest of literature and the sciences, and all seminaries of them. John Adams, Thoughts on Government, 1776

A morsel of genuine history is a thing so rare as to be always valuable. Thomas Jefferson, September 8, 1817

All eyes are opened, or opening, to the rights of man. The general spread of the light of science has already laid open to every view the palpable truth, that the mass of mankind has not been born with saddles on their backs, nor a favored few booted and spurred, ready to ride legitimately, by the grace of God. Thomas Jefferson, letter to Roger C. Weightman, June 24, 1826

At the establishment of our constitutions, the judiciary bodies were supposed to be the most helpless and harmless members of the government. Experience, however, soon showed in what way they were to become the most dangerous; that the insufficiency of the means provided for their removal gave them a freehold and irresponsibility in office; that their decisions, seeming to concern individual suitors only, pass silent and unheeded by the public at large; that these decisions, nevertheless, become law by precedent, sapping, by little and little, the foundations of the constitution, and working its change by construction, before any one has perceived that that invisible and helpless worm has been busily employed in consuming its substance. In truth, man is not made to be trusted for life, if secured against all liability to account. Thomas Jefferson, letter to Monsieur A. Coray, Oct 31, 1823

Equal and exact justice to all men, of whatever persuasion, religious or political. Thomas Jefferson, First Inaugural Address, March 4, 1801

For example. If the system be established on basis of Income, and his just proportion on that scale has been already drawn from every one, to step into the field of Consumption, and tax special articles in that, as broadcloth or homespun, wine or whiskey, a coach or a wagon, is doubly taxing the same article. For that portion of Income with which these articles are purchased, having already paid its tax as Income, to pay another tax on the thing it purchased, is paying twice for the same thing; it is an aggrievance on the citizens who use these articles in exoneration of those who do not, contrary to the most sacred of the duties of a government, to do equal and impartial justice to all its citizens. Thomas Jefferson, letter to Joseph Milligan, April 6, 1816

History by apprising [citizens] of the past will enable them to judge of the future; it will avail them of the experience of other times and other nations; it will qualify them as judges of the actions and designs of men; it will enable them to know ambition under every disguise it may assume; and knowing it, to defeat its views. Thomas Jefferson, Notes on the State of Virginia, Query 14, 1781

I have sworn upon the altar of God, eternal hostility against every form of tyranny over the mind of man. Thomas Jefferson, letter to Benjamin Rush, September 23, 1800

I think all the world would gain by setting commerce at perfect liberty. Thomas Jefferson, July 7, 1785

If a nation expects to be ignorant — and free — in a state of civilization, it expects what never was and never will be. Thomas Jefferson, letter to Colonel Charles Yancey, January 6, 1816

Is it the Fourth? Thomas Jefferson, evening July 3; Jefferson died the next morning, July 4, 1826

It is not honorable to take mere legal advantage, when it happens to be contrary to justice. Thomas Jefferson, Opinion on Debts Due to Soldiers, 1790

It is the duty of every good citizen to use all the opportunities which occur to him, for preserving documents relating to the history of our country. Thomas Jefferson, letter to Hugh P. Taylor, October 4, 1823

It should be our endeavor to cultivate the peace and friendship of every nation.... Our interest will be to throw open the doors of commerce, and to knock off all its shackles, giving perfect freedom to all persons for the vent to whatever they may choose to bring into our ports, and asking the same in theirs. Thomas Jefferson, Notes on the State of Virginia, Query 22, 1787

Natural rights [are] the objects for the protection of which society is formed and municipal laws established. Thomas Jefferson, letter to James Monroe, 1791

No government ought to be without censors & where the press is free, no one ever will. Thomas Jefferson, September 9, 1792

The boisterous sea of liberty is never without a wave. Thomas Jefferson, letter to Richard Rush, October 20, 1820

The care of human life and happiness, and not their destruction, is the first and only legitimate object of good government. Thomas Jefferson, letter to The Republican Citizens of Washington County, Maryland, March 31, 1809

The tree of liberty must be refreshed from time to time with the blood of patriots and tyrants. It is its natural manure. Thomas Jefferson, letter to William Stephens Smith, November 13, 1787

An ELECTIVE DESPOTISM was not the government we fought for; but one which should not only be founded on free principles, but in which the powers of government should be so divided and balanced among several bodies of magistracy, as that no one could transcend their legal limits, without being effectually checked and restrained by the others. James Madison, Federalist No. 48, February 1, 1788

Equal laws protecting equal rights — the best guarantee of loyalty and love of country. James Madison, letter to Jacob de la Motta, August 1820

In Europe, charters of liberty have been granted by power. America has set the example ... of charters of power granted by liberty. This revolution in the practice of the world, may, with an honest praise, be pronounced the most triumphant epoch of its history, and the most consoling presage of its happiness. James Madison, National Gazette Essay, January 18, 1792

No man is allowed to be a judge in his own cause, because his interest would certainly bias his judgment, and, not improbably, corrupt his integrity. James Madison, Federalist No. 10, November 23, 1787

We have heard of the impious doctrine in the old world, that the people were made for kings, not kings for the people. Is the same doctrine to be revived in the new, in another shape — that the solid happiness of the people is to be sacrificed to the views of political institutions of a different form? It is too early for politicians to presume on our forgetting that the public good, the real welfare of the great body of the people, is the supreme object to be pursued; and that no form of government whatever has any other value than as it may be fitted for the attainment of this object. James Madison, Federalist No. 45, January 26, 1788

As to Taxes, they are evidently inseparable from Government. It is impossible without them to pay the debts of the nation, to protect it from foreign danger, or to secure individuals from lawless violence and rapine. Alexander Hamilton, Address to the Electors of the State of New York, March, 1801

History affords us many instances of the ruin of states, by the prosecution of measures ill suited to the temper and genius of their people. The ordaining of laws in favor of one part of the nation, to the prejudice and oppression of another, is certainly the most erroneous and mistaken policy. An equal dispensation of protection, rights, privileges, and advantages, is what every part is entitled to, and ought to enjoy... These measures never fail to create great and violent jealousies and animosities between the people favored and the people oppressed; whence a total separation of affections, interests, political obligations, and all manner of connections, by which the whole state is weakened. Benjamin Franklin, Emblematical Representations, Circa 1774

Strangers are welcome because there is room enough for them all, and therefore the old Inhabitants are not jealous of them; the Laws protect them sufficiently so that they have no need of the Patronage of great Men; and every one will enjoy securely the Profits of his Industry. But if he does not bring a Fortune with him, he must work and be industrious to live. Benjamin Franklin, Those Who Would Remove to America, February, 1784

Where liberty dwells, there is my country. Benjamin Franklin (attributed), letter to Benjamin Vaughn, March 14, 1783

Without Freedom of Thought there can be no such Thing as Wisdom; and no such Thing as Public Liberty, without Freedom of Speech. Benjamin Franklin, writing as Silence Dogood, No. 8, July 9, 1722

Society in every state is a blessing, but government, even in its best state, is but a necessary evil; in its worst state an intolerable one; for when we suffer or are exposed to the same miseries by a government, which we might expect in a country without government, our calamity is heightened by reflecting that we furnish the means by which we suffer. Thomas Paine, Common Sense, 1776

Freedom had been hunted round the globe; reason was considered as rebellion; and the slavery of fear had made men afraid to think. But such is the irresistible nature of truth, that all it asks, and all it wants, is the liberty of appearing. Thomas Paine, Rights of Man, 1791

This new world hath been the asylum for the persecuted lovers of civil and religious liberty from every part of Europe. Hither have they fled, not from the tender embraces of the mother, but from the cruelty of the monster; and it is so far true of England, that the same tyranny which drove the first emigrants from home, pursues their descendants still. Thomas Paine, Common Sense, 1776

Viewed from Washington, it's hard to believe the Ireland depicted in the film The Commitments even existed 15 years ago. When the 20-somethings depicted in that movie discussed career opportunities, the inevitable question was: "When are you going?’' As in - to the US for a job. Not any more.

Viewed from Washington, it's hard to believe the Ireland depicted in the film The Commitments even existed 15 years ago. When the 20-somethings depicted in that movie discussed career opportunities, the inevitable question was: "When are you going?’' As in - to the US for a job. Not any more.