Allister Heath reports that Macedonia will become the 10th Eastern country to adopt the flat tax. In fact, courageous Macedonian step ahead of the Western tax policies highlights increasingly high levels of taxation and government spending. The corporate tax will be set at 12 percent in 2007 while then the government furtherly plans to slash it down to 10 percent in 2008. Lowering tax rates on both personal and corporate income is one of the foremost steps to attract more foreign direct investment as well as to let the tax evasion go down. The newest tax agenda will replace 17 percent corporate tax rate on profits and personal income tax ranging from 15 to 24 percent. Another highly relevant characteristics is that the tax on reinvested profits will be scrapped. There will also be a zero-taxed personal allowance. Now Macedonia will join the bandwagon of the flat tax tigers, among them are Estonia, Slovakia, Latvia, Lithuania, Russia, Serbia, Ukraine and Georgia. Until now, Georgia has had the lowest rated flat tax at 12 percent. In 2008, Macedonia will took the wheel of the leading tax reformist in the region due to furtherly enacted more competitive flat tax rate.

Flat tax boosts economic growth by improving incentives to live, work, save and invest. Lower and non-discriminatory tax rates embody no incentives and reasons for tax evasions. In fact, flat tax drops administrative costs since taxpayers fill their tax returns on a postcard-sized tax report. Flat tax, coupled with other sustainable and productive measures, improves the conditions on financial markets. Therefore, the market becomes more attractive and investors find it interestingly useful to invest and establish new financial centers in order to boost entrepreneurial efforts and ideas as well as to give them strong support in making their projects possible. On the other side, flat tax gives investors more incentives to turn their attention to increasing the human capital of the firm and of the economy as a whole. Since human capital is the main generator of the economic growth, only low taxes and more private universities and colleges can give very much needed incentives to attract more global human capital and let.

Despite being small, Macedonia showed how small tigers can roar loud.

Thursday, November 16, 2006

Monday, November 13, 2006

ASIAN ECONOMY HEADING FOR SLOWDOWN?

Business Week reports that Asia's regional economy would be deprived by lower economic growth rate primarily due to higher oil prices, slower speed of the U.S. economic growth and quite volatile financial markets. APEC report estimated that the economic growth of Asia's regional economies would consolidate at 4,3 percent in 2007 compared to 5 percent in 2006. The economic growth would partly be lowered because of higher oil prices and higher interest rates. Political instability and major threats of terrorism could put up some damaging impact on the economic growth as well. APEC reported that after the U.S. economy chills out, China will be the alternate source of demand. Thus, it is estimated that Chinese economy will continute to grow at double-digit growth rate. Robustly boosted private consumption could energize Japanese economy, growing 2,2 percent in the next year.

Sunday, November 12, 2006

MURRAY ROTHBARD ON THE ESSENCE OF FREE MARKET

"The free market and the free price system make goods from around the world available to consumers. The free market also gives the largest possible scope to entrepreneurs, who risk capital to allocate resources so as to satisfy the future desires of the mass of consumers as efficiently as possible. Saving and investment can then develop capital goods and increase the productivity and wages of workers, thereby increasing their standard of living. The free competitive market also rewards and stimulates technological innovation that allows the innovator to get a head start in satisfying consumer wants in new and creative ways."

Murray Rothbard, Free Market, The Concise Encyclopedia of Economics

Murray Rothbard, Free Market, The Concise Encyclopedia of Economics

OPPORTUNITIES, PRIVATIZATION AND ENTREPRENEURSHIP; THE ONLY WAY TO DEMOLISH POST-COMMUNISM IN CENTRAL AND EASTERN EUROPE

As an economist I have been paying a lot of attention to the process of transition in the framework of economic change in post-communist states in Central and Eastern Europe. There have been several success stories in this part of Europe. But shadows at Europe’s postulated area of economic transition are still persistent. A great amount of restraints remains as the opponent barrier to creating new opportunities. Privatization is still lacking behind the very much needed speed while entrepreneurs still suffer from high taxes, enormously explosive fiscal burden and insufficient protection of intellectual as well as of private property rights. And those three needed features are among the very first steps to demolish the repressive legacy of post-communist economic policy.

After nearly a decade of the collapse of communism, the entire picture of Eastern European economies is broadly different across those countries. Estonia, at the very beginning the economic slave, took a radical approach to economic policy. The country under the leadership of Europe’s most progressive reformist Mart Laar privatized more than 90 percent of all governmentally-owned enterprises. Inflation was dropped below 5 percent immediately after the Estonian government enacted monetary reform. The country opened itself to the rest of the world by eliminating tariffs and quotas on imports. The results were impressive. Perhaps the most striking surprise, criticized by many collectivists and falsified intellectuals from Western Europe, was the enactment of a single flat tax on both personal and corporate income. As a significant outcome of free-market reform a small tiger from the edge of Eastern Europe became the leading tiger in enacting economic reforms. On behalf of himself, Mart Laar emphasized that only free trade makes nations prosperous, not foreign aid. He told that, despite being a historian, he read only book from economics, namely Milton Friedman’s Free to Choose. This book, he said, gave him everything he needed to know to launch economic reforms that made Estonia an economic miracle among the sleeping lads in Central as well as Eastern Europe. Latvia and Lithuania quickly followed Estonia’s experiment and quickly graduated from the maturity of transitional reforming. Foreign investment started to grow greatly in those countries. Investors benefited from low taxation of corporate income. The protection of intellectual and property rights has been modest but definitely more sufficient than in other post-communist countries.

Czech Republic and Slovakia split-up in 1993. Slovakia came under the leadership of Vladimir Meciar, whose government ruled Slovakia with an iron fist, so that Madleine Albright remarked Slovakia as “a black hole in the heart of Europe”. Immediately after Mikulas Dzurinda and Ivan Miklos took the leadership of a structurally demolished country in their own hands, Slovakia became a part of success story. The reforms included the enactment of the flat tax, the removal of restrictions on foreign investors and a privatization at an accelerated speed. Economic growth boomed. Investors in automobile industry such as Peugeot and Volkswagen chose Slovakia for the location of production facilities partly because of the comparatively cheap labor force but primarily because of highly stimulating tax regime. KIA has recently chosen a small Slovakian town of Zilina where it will launch an automobile production facility and process. Slovakia already rates at the top according to produced cars per capita. IBM’s business report on global investment location placed Slovakia among the top five in the world according to the number of new investment projects brought to Slovakia. Hungary relatively successfully transformed its collectivist economy into a free-market oasis in the very central part of Europe. The primary reason why Hungary was poured by foreign investment has been the corporate tax rate of 16 percent which is the second lowest rate on corporate income in Europe.

But a bunch of structural problems remain high. Macroeconomic stability is very far from being mature. Hungary has prolonged its policy of constant annual budget deficit which temporarily equals 9 percent of the entire GDP. At the very beginning of the transition Hungarian central bank directly fixed the exchange rate after the inflation peaked at the rate over one hundred percent. But the vastness of problems, coming out as a result of an unreformed government remained broadly increased. Today, one quarter of the labor force is employed in the public administration. Despite its enormousness and explosive expansion, the administration does very little. The protection of private property rights, seen in the profile of the judicial maturity is still very weak and very far from being mature enough to be modestly satisfied with. Above all, the situation of public finance needs to be reformed because Hungary expects to enter the European Monetary Union in 2011. On the other side, the EU has loaded Hungary with seriously threatening impositions of tax harmonization. Thus, Hungarian policy-makers and inefficient decision-makers employed in the public sector responded immediately by raising and imposing new taxes. The corporate tax rate was lifted above the previous rate of 16 percent. On the other side, solidarity tax was imposed as well. And according to recently announced statistics, tax burden measured in the percentage of the GDP is growing also.

Government spending is rising while those outlays are primarily contributed to financing welfare-based programs such as social security and health-care schemes. In the survey explored by Tanzi, Schuknecht and Alfonso, the authors showed the Hungary, as well as Slovenia, suffers from a very low efficiency of government spending in health-care industry despite one of the highest rates of health-care spending. The level of Hungarian competitiveness is going deeply down after Hungarian socialist policy-makers decided not to impose very much needed reforms. There are some featured demographic problems persistent as well. The birth rate remains low and many youthful and enthusiastic Hungarians find new employment perspectives therein. And there’s an empirically verified fact that brain-drain effects coupled low capital formation could be the beginning of an economic and structural downturn. But Hungary is not the sole problem. There’s Poland as well whose structural performance is lagging strongly behind the very much-needed pace.

The unemployment rate s 15 percent and country’s competitive shift on the lower level continues to be strong. According to annually announced Index of Economic Freedom, Poland reaches the lowest score on competitiveness itself. Gradually determined approach to transition resulted in a series of crises. The inefficiency of the public administration remained unreformed. The education system is very far from giving youth a proper knowledge to create added value in the business sector and to solve the problems successfully. Financial sectors, one of the key determinants of economic prosperity in the future, have been continually weak and mostly deficient since banks were not able to offer enterprises a strong financial support to their business projects. But the reason for this drip is hidden somewhere else. After the beginning of transition many Polish enterprises remain structurally as well as technologically depressed. Political influence over the economy came out as a general problem of entrepreneurial future development. Because politically appointed managers practice bureaucratic administering rather than risk-taking, they were strongly irresponsible when seriously condemned problems came up. In the nature of protectionism, including unimaginably high tariffs and quotas on imports, Poland avoided making gains from international trade. Wage policies were done highly unmarketable. Public sector’s outcome remained low while new taxes and welfare-supported governmental programs started growing like mushrooms after the rainfall.

Slovenia was traditionally reputed as the most developed post-communist state. Country has indeed made some significant progress in the period of past ten years. In fact, Slovenia will be the very first post-communist country to enter the EMU and adopt Euro in 2007 but the whole story is not like goofy fairytale. Slovenian labor market is one of the worst problems. Significant institutional protection of trade unions made them behave not in compliance with market rules but in the seeking of governmental protection. Politicians never decided to gain very much needed power to beat the unions. Even worse, they promoted them as key-partners in the process of collective bargaining. Macroeconomic discipline varied strongly. Inflation-targeting has been predominantly unattained. Inflation was not reduced immediately but it took numerous years to put it below the required rate of Maastricht criteria. Gradualism has truly been the inhibitor of transition which is seen in the behavior of the central bank, its willingness to start creating new monetary aggregates postulated in higher rate of inflation. The problem of inflation is primarily connected with catastrophically attained trade policy. Central Bank, instead of focusing on inflation, put its attention to exchange rate configuration. Thus it controlled the value of Slovenian tolar and implicitly forged industrial policy since exporters were given a preferred position in the international trade of one of the smallest countries in Europe. Previously underpinned problems of the labor market reflected in a very deficient business environment with barriers and obstacles. Foreign investment participation remained very low, perhaps at the lowest rate in Central Europe. Even domestically unreformed industrial enterprises resulted in more than 25 percent of “dependent employment”.

Strong institutional status of trade unions colored with threats to businessmen and entrepreneurs prevented enterprises from being structurally sophisticatedly reformed. Thus, a quarter of the labor force was decidedly put in a risky position. Economically, the behavior of the labor force remained chained in the socialistically flavored culture of denying itself to reeducate and become competitive on the labor market. In 1999, only 5 percent of Slovenian exports were natured as high-technological. In Hungary, the rate of high-tech exports peaked at the rate above 10 percent. In Ireland, for example, 53 percent of exports were high-tech based. But the main core of the problem does not lie solely in the business sector. Slovenia is comparably very weak at producing innovations. Old-fashioned innovation structure established itself on the basic research. Slovenian state-based universities offer very poor knowledge as well as they, in cooperation with business sector, remain unwilling to remunerate the fruits of knowledge in applications and device mechanisms. Private sector has a minimal role in the structure of educational institution. In fact, there’s none Slovenian university among the top five-hundred in the world. Increasingly growing role of the government in education resulted in a very slow technological progress that could be accelerated if private sector took the leadership in technological innovations produced at the university. If Slovenia continued registering patents at international patent institutions at the current rate, then it would get in touch with the average European level of knowledge development in three hundred years (!).

According to Eurostat, there are only 65 percent of private activities in the structure of the GDP compared to 80 percent rate in Czech Republic. The role of the government is still very strong. Here we can open the chapter of privatization. When privatization was launched, the structure of the ownership remained very rigid and not perspective for the future development of products and services. Many government officials have been actively engaged in decision-making in big companies. KAD and SOD, the main para-governmental funds, have been insufficient owners and their role resulted in less effective and less productive decisions of the companies itself. The entire management of the biggest companies was occupied with government officials. Their intention was not to let the business and developments grow greatly but to control the development of enterprises. The role of those funds was strongly persistent in financial sector which limited the potentials of the private sector itself. Financial sector was largely uncompetitive due to non-dynamic behavior on the market. Venture capital funds rarely occurred and there were hardly found new products on the financial markets.

To demolish post-communism in Central and Eastern Europe, entrepreneurship, capital formation, productive behavior and reforms of the government are the only effective means to achieve that. Lower tax rates, on both personal and corporate income (flat tax), institutional transparency and efficiency, reduced government spending, accelerated privatization of public sector, health-care and social security, eliminating the restrictions on capital and financial markets, small but efficient administration, respectful protection of private and intellectual property rights, the abolishment of the minimum wage and further enactment of free-market institutions upon pro-growth orientation of economic policy are likely to be the most prosperous path to create new opportunities in Central and Eastern Europe and therefore let its economies grow. In fact, there is in a competitive society nobody who could posses only a fraction of power which a socialist planning board and explosive governmental role can exercise.

After nearly a decade of the collapse of communism, the entire picture of Eastern European economies is broadly different across those countries. Estonia, at the very beginning the economic slave, took a radical approach to economic policy. The country under the leadership of Europe’s most progressive reformist Mart Laar privatized more than 90 percent of all governmentally-owned enterprises. Inflation was dropped below 5 percent immediately after the Estonian government enacted monetary reform. The country opened itself to the rest of the world by eliminating tariffs and quotas on imports. The results were impressive. Perhaps the most striking surprise, criticized by many collectivists and falsified intellectuals from Western Europe, was the enactment of a single flat tax on both personal and corporate income. As a significant outcome of free-market reform a small tiger from the edge of Eastern Europe became the leading tiger in enacting economic reforms. On behalf of himself, Mart Laar emphasized that only free trade makes nations prosperous, not foreign aid. He told that, despite being a historian, he read only book from economics, namely Milton Friedman’s Free to Choose. This book, he said, gave him everything he needed to know to launch economic reforms that made Estonia an economic miracle among the sleeping lads in Central as well as Eastern Europe. Latvia and Lithuania quickly followed Estonia’s experiment and quickly graduated from the maturity of transitional reforming. Foreign investment started to grow greatly in those countries. Investors benefited from low taxation of corporate income. The protection of intellectual and property rights has been modest but definitely more sufficient than in other post-communist countries.

Czech Republic and Slovakia split-up in 1993. Slovakia came under the leadership of Vladimir Meciar, whose government ruled Slovakia with an iron fist, so that Madleine Albright remarked Slovakia as “a black hole in the heart of Europe”. Immediately after Mikulas Dzurinda and Ivan Miklos took the leadership of a structurally demolished country in their own hands, Slovakia became a part of success story. The reforms included the enactment of the flat tax, the removal of restrictions on foreign investors and a privatization at an accelerated speed. Economic growth boomed. Investors in automobile industry such as Peugeot and Volkswagen chose Slovakia for the location of production facilities partly because of the comparatively cheap labor force but primarily because of highly stimulating tax regime. KIA has recently chosen a small Slovakian town of Zilina where it will launch an automobile production facility and process. Slovakia already rates at the top according to produced cars per capita. IBM’s business report on global investment location placed Slovakia among the top five in the world according to the number of new investment projects brought to Slovakia. Hungary relatively successfully transformed its collectivist economy into a free-market oasis in the very central part of Europe. The primary reason why Hungary was poured by foreign investment has been the corporate tax rate of 16 percent which is the second lowest rate on corporate income in Europe.

But a bunch of structural problems remain high. Macroeconomic stability is very far from being mature. Hungary has prolonged its policy of constant annual budget deficit which temporarily equals 9 percent of the entire GDP. At the very beginning of the transition Hungarian central bank directly fixed the exchange rate after the inflation peaked at the rate over one hundred percent. But the vastness of problems, coming out as a result of an unreformed government remained broadly increased. Today, one quarter of the labor force is employed in the public administration. Despite its enormousness and explosive expansion, the administration does very little. The protection of private property rights, seen in the profile of the judicial maturity is still very weak and very far from being mature enough to be modestly satisfied with. Above all, the situation of public finance needs to be reformed because Hungary expects to enter the European Monetary Union in 2011. On the other side, the EU has loaded Hungary with seriously threatening impositions of tax harmonization. Thus, Hungarian policy-makers and inefficient decision-makers employed in the public sector responded immediately by raising and imposing new taxes. The corporate tax rate was lifted above the previous rate of 16 percent. On the other side, solidarity tax was imposed as well. And according to recently announced statistics, tax burden measured in the percentage of the GDP is growing also.

Government spending is rising while those outlays are primarily contributed to financing welfare-based programs such as social security and health-care schemes. In the survey explored by Tanzi, Schuknecht and Alfonso, the authors showed the Hungary, as well as Slovenia, suffers from a very low efficiency of government spending in health-care industry despite one of the highest rates of health-care spending. The level of Hungarian competitiveness is going deeply down after Hungarian socialist policy-makers decided not to impose very much needed reforms. There are some featured demographic problems persistent as well. The birth rate remains low and many youthful and enthusiastic Hungarians find new employment perspectives therein. And there’s an empirically verified fact that brain-drain effects coupled low capital formation could be the beginning of an economic and structural downturn. But Hungary is not the sole problem. There’s Poland as well whose structural performance is lagging strongly behind the very much-needed pace.

The unemployment rate s 15 percent and country’s competitive shift on the lower level continues to be strong. According to annually announced Index of Economic Freedom, Poland reaches the lowest score on competitiveness itself. Gradually determined approach to transition resulted in a series of crises. The inefficiency of the public administration remained unreformed. The education system is very far from giving youth a proper knowledge to create added value in the business sector and to solve the problems successfully. Financial sectors, one of the key determinants of economic prosperity in the future, have been continually weak and mostly deficient since banks were not able to offer enterprises a strong financial support to their business projects. But the reason for this drip is hidden somewhere else. After the beginning of transition many Polish enterprises remain structurally as well as technologically depressed. Political influence over the economy came out as a general problem of entrepreneurial future development. Because politically appointed managers practice bureaucratic administering rather than risk-taking, they were strongly irresponsible when seriously condemned problems came up. In the nature of protectionism, including unimaginably high tariffs and quotas on imports, Poland avoided making gains from international trade. Wage policies were done highly unmarketable. Public sector’s outcome remained low while new taxes and welfare-supported governmental programs started growing like mushrooms after the rainfall.

Slovenia was traditionally reputed as the most developed post-communist state. Country has indeed made some significant progress in the period of past ten years. In fact, Slovenia will be the very first post-communist country to enter the EMU and adopt Euro in 2007 but the whole story is not like goofy fairytale. Slovenian labor market is one of the worst problems. Significant institutional protection of trade unions made them behave not in compliance with market rules but in the seeking of governmental protection. Politicians never decided to gain very much needed power to beat the unions. Even worse, they promoted them as key-partners in the process of collective bargaining. Macroeconomic discipline varied strongly. Inflation-targeting has been predominantly unattained. Inflation was not reduced immediately but it took numerous years to put it below the required rate of Maastricht criteria. Gradualism has truly been the inhibitor of transition which is seen in the behavior of the central bank, its willingness to start creating new monetary aggregates postulated in higher rate of inflation. The problem of inflation is primarily connected with catastrophically attained trade policy. Central Bank, instead of focusing on inflation, put its attention to exchange rate configuration. Thus it controlled the value of Slovenian tolar and implicitly forged industrial policy since exporters were given a preferred position in the international trade of one of the smallest countries in Europe. Previously underpinned problems of the labor market reflected in a very deficient business environment with barriers and obstacles. Foreign investment participation remained very low, perhaps at the lowest rate in Central Europe. Even domestically unreformed industrial enterprises resulted in more than 25 percent of “dependent employment”.

Strong institutional status of trade unions colored with threats to businessmen and entrepreneurs prevented enterprises from being structurally sophisticatedly reformed. Thus, a quarter of the labor force was decidedly put in a risky position. Economically, the behavior of the labor force remained chained in the socialistically flavored culture of denying itself to reeducate and become competitive on the labor market. In 1999, only 5 percent of Slovenian exports were natured as high-technological. In Hungary, the rate of high-tech exports peaked at the rate above 10 percent. In Ireland, for example, 53 percent of exports were high-tech based. But the main core of the problem does not lie solely in the business sector. Slovenia is comparably very weak at producing innovations. Old-fashioned innovation structure established itself on the basic research. Slovenian state-based universities offer very poor knowledge as well as they, in cooperation with business sector, remain unwilling to remunerate the fruits of knowledge in applications and device mechanisms. Private sector has a minimal role in the structure of educational institution. In fact, there’s none Slovenian university among the top five-hundred in the world. Increasingly growing role of the government in education resulted in a very slow technological progress that could be accelerated if private sector took the leadership in technological innovations produced at the university. If Slovenia continued registering patents at international patent institutions at the current rate, then it would get in touch with the average European level of knowledge development in three hundred years (!).

According to Eurostat, there are only 65 percent of private activities in the structure of the GDP compared to 80 percent rate in Czech Republic. The role of the government is still very strong. Here we can open the chapter of privatization. When privatization was launched, the structure of the ownership remained very rigid and not perspective for the future development of products and services. Many government officials have been actively engaged in decision-making in big companies. KAD and SOD, the main para-governmental funds, have been insufficient owners and their role resulted in less effective and less productive decisions of the companies itself. The entire management of the biggest companies was occupied with government officials. Their intention was not to let the business and developments grow greatly but to control the development of enterprises. The role of those funds was strongly persistent in financial sector which limited the potentials of the private sector itself. Financial sector was largely uncompetitive due to non-dynamic behavior on the market. Venture capital funds rarely occurred and there were hardly found new products on the financial markets.

To demolish post-communism in Central and Eastern Europe, entrepreneurship, capital formation, productive behavior and reforms of the government are the only effective means to achieve that. Lower tax rates, on both personal and corporate income (flat tax), institutional transparency and efficiency, reduced government spending, accelerated privatization of public sector, health-care and social security, eliminating the restrictions on capital and financial markets, small but efficient administration, respectful protection of private and intellectual property rights, the abolishment of the minimum wage and further enactment of free-market institutions upon pro-growth orientation of economic policy are likely to be the most prosperous path to create new opportunities in Central and Eastern Europe and therefore let its economies grow. In fact, there is in a competitive society nobody who could posses only a fraction of power which a socialist planning board and explosive governmental role can exercise.

Tuesday, November 07, 2006

UN-SPONSORED ATTACK ON THE INTERNET GOVERNANCE

UN-sponsored leftist interventionists self-considered as "experts" proposed a deal to give governments more power to determine the language on the web. The aim of the suggested intervention is to promote the so-called "language diversity." However, this clearly seems to be a leftist proposal due to their willingness to remove the spontaneous perfection of the market and replace it with explicit governmental use of forces. Free market should set the course of language diversity on the internet , not governmental powers to use coercion and force.

Monday, November 06, 2006

GLOBAL LOCATION STRATEGIES AND INWARD INVESTMENT

IBM's annual survey of countries receiving investment from multinational companies in the areas of manufacturing, R&D and services revealed Europe regained from Asia its top position in 2005. Europe, as a no.1 position for inward investment attracted 39 percent of all investment projects. Asia's share of inward investment peaked at comparatively competitive level of 31 percent. In 2004, for instance, both countries tied up at 35 percent. The survey, involving global location strategy, reported a rebound by established economies due to strong economic growth while some leading emerging markets, including Eastern Europe, cooled after years of extremely strong investment. The outline of the entire analytical content can be reached here. If you're enthusiastic and want to see more from the survey then you can click here and view the whole powerpoint presentation of the survey.

WHEN SWEDISH MODELS DESTROY THEMSELVES

Johan Norberg offers us a highly realistic view on how socially popular Swedish models devastated Swedish economy and splitted its economy towards falling off the cliff and how "cradle-to-grave" welfare state damaged Swedish economic potentials.

"Sweden retained the world's highest taxes, generous social security systems and a heavily regulated labor market, which split the economy: Sweden is very good at producing goods, but not at producing jobs. According to a recent study of 35 developed countries, only two had jobless growth: Sweden and Finland. Economic growth in Sweden in the last 25 years has had no correlation at all with labor-market participation. (In contrast, 1 percent of growth increases the number of jobs by 0.25 percent in Denmark, 0.5 percent in the United States and 0.6 percent in Spain.) Amazingly, not a single net job has been created in the private sector in Sweden since 1950."

Click here to view the article of the author.

"Sweden retained the world's highest taxes, generous social security systems and a heavily regulated labor market, which split the economy: Sweden is very good at producing goods, but not at producing jobs. According to a recent study of 35 developed countries, only two had jobless growth: Sweden and Finland. Economic growth in Sweden in the last 25 years has had no correlation at all with labor-market participation. (In contrast, 1 percent of growth increases the number of jobs by 0.25 percent in Denmark, 0.5 percent in the United States and 0.6 percent in Spain.) Amazingly, not a single net job has been created in the private sector in Sweden since 1950."

Click here to view the article of the author.

IRELAND IN ITS OWN HAND - A TIGER THAT COULD, A TIGER THAT DARED

In their recent articles, Pierre Fortin and Helen O'Neill characterize the Irish economic transformation in the following way: "Forty years ago Ireland could be described as relatively poor, stagnant and strongly protected economy based on agriculture. The country was faced with massive immigration outflows and was dependent on Great Britain in terms of exports and imports as well ... Today Irish income per capita is above the European average, the share of agriculture in GDP fell below 5 percent, the demographic trends are favorable, while the performance of Irish economy is among the top in the world." Irish dynamically boosted economic transition to one of the most open and best-performed economies in the world was characterized by several strategically important factors. Among them, three prevail in the following order, (a) an accelerated role of foreign investment and ownership in the economic transition, (b) the liberalization of international trade and (c) an incredible degree of openness in foreign trade while the restructuring of the economy played an increasingly important role on a lark as well. In this respect, a dominant promotion of private ownership took contributed very much to the success of Ireland's significant economic transformation. The government sold its shares of monopoly enterprises to private competitors quickly and transparently. The remaining shares of Irish public enterprises are being successfully put into the context of privatization. The sum of serious economic reforms imposed by Irish policy decision-makers has triggered the productivity of the real sector and tripled the expectations of economic growth far above the average of the European Union. All the way through the 90's Irish economy grew robustly by nearly 80 percent per year. Today, Ireland embodies the spot of opportunities for investors from all around the world. The corporate tax rate was slashed from previous 16 percent to current 12,5 percent. With this spectacular rate, Ireland's corporate tax rate is among the lowest in the world. Coupled with favorable geostrategic position, Irish business environment opened-up its place to numerous multinational companies from overseas. Foreign investors enjoy the same level of legal protection as domestic companies while there are practically no persistent restrictions for incoming foreign investors. After the corporate tax rate was lowered and some remaining restrictions slashed, Ireland has become the top destinations for U.S. multinationals. One third of the entire U.S. foreign investment worldwide is operating in Ireland while the U.S. is Ireland's top export destinations. Roughly 30 percent of all Irish goods and services are exported to the U.S. In 2004, the real GDP grew by 4,9 percent, the highest rate among the members of the European Monetary Union. On the other hand, sound financial institutions indeed stood there as one of the foremost components in the advancement of small country on the edge of Europe (See: Index of Economic Freedom 2006) where the legal establishment of private property rights has been strong and intellectual property very well protected against abuses (CATO, 2003) and where the barriers to foreign investment participation have been minimal (IMD, 2006). Series of other drastically relevant studies fatherly confirm the soundness of Irish business-friendly environment. Thus, if Irish, as well as foreign investors want to setup an enterprise then he's obliged to go through only four procedures, most of them can be done online and Irish new investors also don't need a minimal deposit in registering for his number of the bank account (World Bank, 2006). Another successful page of Irish economic transition presents the transparency of institutional framework. Its role has been primarily focused on the following chapters of major problems, (1) a huge public debt, (2) a deep deficit in the balance of payments, and (3) constantly high level of inflation. From 1980 to 1985, the unemployment instantly peaked at 13 percent of the entire active labor force. Throughout the restricted approach to public finance and fiscal correction, the annual budget was no longer caved in deficit. It moved to the surplus for the very first time. The ratio between public debt and Gross National Product downsized from 108, 5 percent in 1993 to 55,1 percent in 1999. The entire role of the institutions succeeded primarily because of sound establishment in managing institutions as whole. Committed to rules instead of discretion, Irish central bank stabilized the monetary framework of the country until euro was adopted as a single currency. The economic policy of choice equipped policy-makers with lessons from the latest results of economic policy. Largely unfavorable measures were banished and persistently decreasing trends impaired. Those developmentally-friendly measures included an anticipated further liberalization of labor market, reduced regulation and an accelerated involvement in European integration processes (Baker, 1999). In 1973, Irish GDP equaled exactly 60 percent of the GDP of the average of the European Union. It grew by 6 percent until 1980 while at rapidly accelerated economic growth in 1992 Irish GDP raised up to 88 percent and fatherly to 104 percent in 1994 and 107 percent of the European average in 1997. The 'so-called' social partnership despite having been moderately institutionally protected acted decently so they didn't disturb further economic growth. Trade unions didn't cluster the developmental progress with collective bargaining as they do in Slovenia. Even more, throughout the period of economic transition, Irish trade unions promoted a greater participation of foreign investors. On the other side, Irish trade unions strongly supported price competition and the liberalization of labor market also. The supporters of statism take Ireland as an example of how subsidies from structural funds work and how European Union successfully financed Irish development. Their misinterpreted arguments, however, are very far from being relevant. Previously mentioned promotion of direct inflows of foreign investment was side-by-side characterized by the remission of capital gains and dividends to foreign and domestic investors, fatherly supported by tax incentives aiming to boost productive behavior at continually minimized administrative barriers. There was also a highly sophisticated approach of so-called developmental agencies. Their primary role was not concentrated on acting in terms of intervention but it was focused strictly on reforming rigid an persistent macrostructures. In a detailed panel paper, Patrick Honohan and Brendan Walsh estimate that the total amount of FDI flows measure relative to GDP already exceeded the entire amount of subsidies financed from the European structural funds.

From Adam Smith onward, demographic trends play a highly relevant role in the process of growth, productivity and labor market structures as well. According to the data available, Irish demographic picture had been continually catastrophic. From 1841 to 1961 the entire population decreased from 6,5 million to 2 million. The main reason for this was the desire of many Irishmen to pursue better standard of living so by and large they immigrated mostly to the U.S., Australia and Canada. After the series of measure had been undertaken, in 35 years the population grew robustly by 35 percent while the participation rate on the labor market increased by 42 percent.

Irish economic growth was, aside from the demographic turnover, supplied with one of the friendliest environments for foreign investors as well as with export-oriented economy. Ireland also enjoys the biggest share of high-tech products in its export structure (OECD, 2001). The biggest threat to Irish continually stable economic growth is the potential recession in the U.S. market (OECD 2004, Baker, 2003). The majority of international investors in Ireland are U.S. companies while the U.S. is Ireland's top export destination.

Another important factor underlying Irish economic growth was the convergence of total factor productivity which externally helped Irish companies to boost exports and helped to increase Irish international competitiveness after taking a larger role in the international trade. Sufficiently flexible labor market helped increase female labor market participation rate. It equaled 65 percent in 1993. The creation of new jobs absorbed large inflows of foreign labor force. Friendly legislation has thankfully not imposed barriers and restrictions to employing foreign workers, mostly from Eastern Europe. Flexible and efficiently non-patched labor market coupled with laws which minimized the administrative obstacles for business start-ups, has given a huge basis for future economic growth (O'Gorman, 2005).

Ireland could be graded with A on the level of macroeconomic policy also. Tax burden measured in GDP percentage currently stands at 30, 2 percent of the GDP which is one of the lowest among OECD countries. GDP (PPP) ranks among the highest eight ones in the world according to CIA World Factbook. Irish level of economic freedom has been triggered up to the third-highest level of economic freedom in the world (Heritage, 2006).

Swedish think-thank Timbro estimated that if American economy were frozen in 2010, only Ireland would catch it up in five years. For example, if Sweden wanted to catch up the U.S. GDP and if American economy were frozen, then it would reach the U.S. level of GDP no sooner than in 2027.

Irish challenge was from the beginning handicapped and continually hurdled with series of civil wars and damaging devastations. Its further developmental policies were all based on non-governmental intervention. Further steps were taken through series of measures including business-friendly tax legislation, openness in international trade, increased role of foreign investment and "baby boom" generation ((Fitz Gerald, Kearney, Morgenroth, Smyth 1999). Currently accelerated pace of total factor productivity growth in the real sector is putting a small bite-roaring Celtic tiger closer in the battlefield with the growth and structure of total factor productivity in the U.S.

Monday, October 30, 2006

SAXO BANK GOES INTO THE FLOW OF FREE TRADING

Recently announced, Danish investment bank Saxo will abolish the minimum ticket fee and percentage commission on Danish stocks. Saxo will therefore become the very first Scandinavian bank to approach to zero-commission online share trading. Improving the financial conditions for shareholders and online traders is definitely one of the key features to gain success along global benefits of free online trading, increased competition and better efficiency among customers in online trading. Global market as a whole is generally headed toward increasingly smaller commissions. According to Christopher Noon from Forbes, Saxo's zero-commission trading extends offer to retail clients as well as new clients with a minimum account balance of 50,000 Danish Krone ($8,393). These clients can trade online with zero-commission up to 50 times a month on the Danish stock market. Saxo's Vice Chief Executive is not expecting to take away business from traditional online traders such as E*Trade, IFX Markets, Charles Schwab and StockTrade. According to his words, only 10% to 20% of e-trade business actually comes from equity trading. Saxo's furtherized ambitious agenda also includes plans to access of the its initiative before exporting the idea across borders.

Friday, October 27, 2006

Monday, October 23, 2006

SETTING THE STAGE TO SOAR FUTURE ECONOMIC GROWTH

It seems that U.S. Congress is captured by an unwillingness when it comes to shift from social security programs to ownership-based retirement programs. U.S. Congress actually made a huge failure due to permanently maintain tax reforms that would eliminate the death tax and cut marginal tax rates on capital gains and dividends. In the U.S., the economic growth has been higher for most of the decades than it was overseas. But also editorial pages have been enriched with the words from Milton Friedman and other Chicago guys. They firmly set the intelectual foundation for an economic policy based on low taxation, market competition and individual ownership. However, today you won't find those words written in English. Instead they are printed in Estonian, Hindi and Spanish as well as in other languages where policy-makers decided to shift the wheel of economic policy towards the implementation of free-market ideas. They have been, of course, successfully implemented. It was amazing to see how the idea of Private Retirment Accounts (PRA's) exploded in South America. Chilean labor minister Jose Pinera boldly ran the Chicago vision back in 1981 and the results of this encouragement are still seen in Santiago today. Chile's current national saving rate accounts 21 percent of the GDP. Following the Chilean example, at least 30 other nations followed that way, having replaced benefit pension systems with individual ownership and personal control, including countries such as Denmark and Sweden. Former communist nations in Eastern Europe also enacted pro-growth and free-market economic reforms, wathcing their economies setting the path for future economic growth. Simple, dynamic and low-cost flat tax codes encourage people to work more as well as to expand economic activity more rapidly. Recently, Estonia has reached the edge of economic growth soaring over an amazing 10 percent. In the past six and seven years, the rates of economic growth in Baltic countries, including Latvia and Lithuania, averaged 8 percents consistently. Seeing the situation today, more than 9 countries have adopted the flat tax code, including Russia and Romania. Conversely, the U.S. Congress consumes its days. Instead of debating how to cut public consumption rate and improve macroeconomic situation, Congressmen are rather busy with intensive debates on how to impose taxes on energy profits. While America is still the greatest pillar of newly-born ideas, it is not the leader in tax competition anymore. The U.S. federal tax code is grasply written on 66 498 pages, adding $265 billion compliance costs. Currently, the U.S. Government is facing a long-term problem of how to cut unfunded liabilities in retirement systems such as Social Security and Medicare. Those programs amount to $80 trillion. Therefore, work force is facing a shrinking benefits and higher tax rates while Congress still remains unwilling to impose serious reforms to cut those benefits and provide a decent and sustainable way of living to thousands of Americans in the future. Giving workers the right to choose ownership-contribution retirement system would helpfully replace current massive debt, giving individuals real ownership and control would ensure and secure better financial future for each member of the big hub, namely "taxpayers". Continually prolonged retirement systems based upon massive outlays for Social Security and Medicate programs would, on the long term, result in higher tax rates on income and capital gains, higher public debt while economic growth would start to push the economy towards falling off the cliff. The consequences of this way of spending and economic policy-making would be painful for everyone. Rising taxes on labor and capital formation would cause capital flight, economic contraction and high unemployment. As an output of "socialized results of production" there would be no means to boost productivity and create more value-added goods and services in order to create a society based on soaring productivity through hard-work and anticipated innovative behavior. Other nations have prospered from economic policy based on economic freedom. Global financial markets are about to judge the efficiency of economic policy, not flashing cameras around the enemies of progress and development. If policy-makers in countries such as the U.S., Slovenia, Italy, Germany, France and Spain will not undertake serious structural reforms capital and investment will quickly fly to other nations where the ideas of Chicago economists work and where economic freedom coupled with low rates on capital and income taxation soundly works as future prosperity peaks and opportunities flourish.

Thursday, October 19, 2006

SINGAPORE - THE FINANCIAL OASIS

Singapore has made significant economic progress based upon favorable conditions for incoming financial institutions that set-up their assets in small Asian city state such as Singapore. In fact, the economic and financial policy coupled with low corporate tax rates and comparatively modest fiscal burden has created very stable financial environment for incoming capital flows and foreign investors as well. However, Singapore went ahead of other global competitors. Its recent measures were done in order to revitalize the financial marketplace. Policy-makers in a small and highly competitive Asian city decided to furtherly adapt banking secrecy laws, much of its tax and trust policy in a recent drive to reinvest itself. Nowdays, investors in banking industry usually take a closer look at country's secrecy laws, taxation on interest bearing and capital gains and taxation in terms of residency and trust policy. But this is generally speaking not the entire framework of sets of decisions. Investors also pay attention to other general banking measures such as set-ups and set-up speed of banking operation and of course regulation as such. One of the very first measures was to boost banking confidentiality laws by imposing a sentence of $78,000 USD for disclosing information. Singapore has also amended its trust laws to allow incoming foreigners to move away from European state interference which dicatates how inheritance is being carved up. Singapore also completely slashed taxes on profits from foreign investment earned abroad and finally reduced corporate tax burden to attract more dynamic businesses. Singapore has therefore followed the example of many Swiss cantons which also adapted similar measure to foster competitive markets. Unlike in European countries, tax evasion is not a criminal act unless proof of sharp practice is found. Singapore managed to foster more growth by bringing more foreign investors into a small cherry-flavoured Asian tiger. These parts of measures have been very favourable and along with other attractive features, those parts are about to fit the competitiveness of Asian financial markets. Unlike in European countries, in fostering growth and developmental progress, Singapore relied on global financial integration by taking various examples in financial capitals such as London, Tokyo, Sydney, Hong Kong and Zurich. The combinations of measures in each of these examples will result in a higher and more rapid growth of Singapore's and Asian financial markets because businesses itself will be able to rely on sustainable options of crediting and other alternatives to continue an amazing move-up of Singapore's growth of entrepreneurial activity particulary in areas which require strong support from the financial industry. But this is not the end of the story at all. One of the Singapore's main strengths is highly sophisticated infrastructure modelled specifically on creating the ambience in order to invigorate and recreate this small and hopefully Asian peer. One of the foremost infrastructural achievements of Singapore has been converting salt water marina into a fresh water lake. One regulation did not transfer ti Singapore - European saving-tax directive imposed on Switzerland by the European Union. This particulary tax law is levied on Swiss accounts of foreign nationals on behalf of their resident countries to counter tax evasion. However it would be a little bit too soon to expect rapid capital flight from Switzerland to Singapore, emptying from Swiss accounts into Singapore's. Turning the issue to Switzerland, there're definitely some investors who have problems with withholding tax. Will this lead to a major capital flow? Perhaps only a little bit. To make this happen, there should be a big thing that moves the needle. Switzerland will definitely not capture future growth market to the extent that once used to. Swiss banks are still setting-up in Switzerland so the government still benefits through greater revenues as a result of low taxation of corporate income and capital gains.

Singapore has made significant economic progress based upon favorable conditions for incoming financial institutions that set-up their assets in small Asian city state such as Singapore. In fact, the economic and financial policy coupled with low corporate tax rates and comparatively modest fiscal burden has created very stable financial environment for incoming capital flows and foreign investors as well. However, Singapore went ahead of other global competitors. Its recent measures were done in order to revitalize the financial marketplace. Policy-makers in a small and highly competitive Asian city decided to furtherly adapt banking secrecy laws, much of its tax and trust policy in a recent drive to reinvest itself. Nowdays, investors in banking industry usually take a closer look at country's secrecy laws, taxation on interest bearing and capital gains and taxation in terms of residency and trust policy. But this is generally speaking not the entire framework of sets of decisions. Investors also pay attention to other general banking measures such as set-ups and set-up speed of banking operation and of course regulation as such. One of the very first measures was to boost banking confidentiality laws by imposing a sentence of $78,000 USD for disclosing information. Singapore has also amended its trust laws to allow incoming foreigners to move away from European state interference which dicatates how inheritance is being carved up. Singapore also completely slashed taxes on profits from foreign investment earned abroad and finally reduced corporate tax burden to attract more dynamic businesses. Singapore has therefore followed the example of many Swiss cantons which also adapted similar measure to foster competitive markets. Unlike in European countries, tax evasion is not a criminal act unless proof of sharp practice is found. Singapore managed to foster more growth by bringing more foreign investors into a small cherry-flavoured Asian tiger. These parts of measures have been very favourable and along with other attractive features, those parts are about to fit the competitiveness of Asian financial markets. Unlike in European countries, in fostering growth and developmental progress, Singapore relied on global financial integration by taking various examples in financial capitals such as London, Tokyo, Sydney, Hong Kong and Zurich. The combinations of measures in each of these examples will result in a higher and more rapid growth of Singapore's and Asian financial markets because businesses itself will be able to rely on sustainable options of crediting and other alternatives to continue an amazing move-up of Singapore's growth of entrepreneurial activity particulary in areas which require strong support from the financial industry. But this is not the end of the story at all. One of the Singapore's main strengths is highly sophisticated infrastructure modelled specifically on creating the ambience in order to invigorate and recreate this small and hopefully Asian peer. One of the foremost infrastructural achievements of Singapore has been converting salt water marina into a fresh water lake. One regulation did not transfer ti Singapore - European saving-tax directive imposed on Switzerland by the European Union. This particulary tax law is levied on Swiss accounts of foreign nationals on behalf of their resident countries to counter tax evasion. However it would be a little bit too soon to expect rapid capital flight from Switzerland to Singapore, emptying from Swiss accounts into Singapore's. Turning the issue to Switzerland, there're definitely some investors who have problems with withholding tax. Will this lead to a major capital flow? Perhaps only a little bit. To make this happen, there should be a big thing that moves the needle. Switzerland will definitely not capture future growth market to the extent that once used to. Swiss banks are still setting-up in Switzerland so the government still benefits through greater revenues as a result of low taxation of corporate income and capital gains.

*The indicators describe three dimensions of investor protection: transparency of transactions (Extent of Disclosure Index), liability for self-dealing (Extent of Director Liability Index), shareholders’ ability to sue officers and directors for misconduct (Ease of Shareholder Suits Index) and Strength of Investor Protection Index. The indexes vary between 0 and 10, with higher values indicating greater disclosure, greater liability of directors, greater powers of shareholders to challenge the transaction, and better investor protection.

Source: World Bank, Doing Business 2006

Wednesday, October 18, 2006

DYNAMIC CAPITALISM

Edmund PHELPS, this year's Nobel Laureate has publish perfectly pin-pointed opinion on the superiority of modern dynamic "laissez faire" capitalism over the so-called social market economy which has primarily taken origins from archaic German and French corporativist models. Institutional protection of interest groups and rent-seekers is now paying the price. Economic growth rates are sluggish, job-creation rarely finds itself productive while international competitiveness of those welfare-based economies (Germany, France, Italy, Slovenia) is falling off the cliff. I recommend you to read the opinion of Edmund Phelps.

"The issues swirling around capitalism today concern the consequences of its dynamism. The main benefit of an innovative economy is commonly said to be a higher level of productivity--and thus higher hourly wages and a higher quality of life. There is a huge element of truth in this belief, no matter how many tens of qualifications might be in order."

- Edmund Phelps

"The issues swirling around capitalism today concern the consequences of its dynamism. The main benefit of an innovative economy is commonly said to be a higher level of productivity--and thus higher hourly wages and a higher quality of life. There is a huge element of truth in this belief, no matter how many tens of qualifications might be in order."

- Edmund Phelps

Friday, October 13, 2006

HONG KONG'S LAISSEZ FAIRE POLICY - TOO GOOD TO LAST?

The story of Hong Kong had been the tale of roaring tiger as a shining example of economic freedom. At the end of World War II, Hong Kong was a dirt-poor island with a per-capita income about one-quarter that of Britain's. When laissez-faire economic policy of positive non-interventionism was adopted, Hong Kong’s territory started to wheel the new era of prosperity and business freedom. Hong Kong began to boom. That was a striking demonstration of the productivity of freedom, of what people can do when they are left free to pursue their own interests. In fact, Hong Kong's remarkable achievement, seen in a rapidly growing economy, benefited its neighboring countries as well. It boosted them to move away from central-planning and move towards the reliance on private enterprise and free-market. As a result, both, Hong Kong and China benefited from rapid economic growth. But Hong Kong's current leader Donald Tsang has recently declared the death of the policy on which the prosperity of small and up-beating tiger had been built.

Milton Friedman, the 1976 Nobel laureate in Economics and the most influential economist of the 20th century bemoans the latest Hong Kong's political shift toward governmental interventionism and statist approach that is forgetting the lessons of the policy that lead Hong Kong toward the miracle of free market. You can read it here.

Milton Friedman, the 1976 Nobel laureate in Economics and the most influential economist of the 20th century bemoans the latest Hong Kong's political shift toward governmental interventionism and statist approach that is forgetting the lessons of the policy that lead Hong Kong toward the miracle of free market. You can read it here.

Monday, October 09, 2006

MASTERING LIBERTARIAN WISDOM

Tomaz has published a great post that gives youthful population very helpful advice about the way of how the youth should look forward to the future. Don't miss that and read the post as quickly as you can.

"Slovenia is a land of contradictions, an Alpine paradise for pensioners with extremely hostile environment to the youth. They are enchained to be forced to pay high progressive taxes that don't take assets into account as well as they're compelled to high prices of real estate. They will sweat longer than current pensioners ever did, they will pay higher social security contributions and at the end they will receive lower pensions. Those who're thrown into the wheel of life without backup basis are only able to create wealth and welfare on their own account respectively. Closer they reach the point of their objectives, more they are pushed to the ground with progressive taxes. The outcome of "socially egalitarian" order is that people spend more time on the workplace and rarely decide to start taking care of themselves as well as they rarely decide to start creating their own families ... And remember, if you're a liberally minded individual living in Slovenia, don't get despaired. Instead, keep on finding the way of how to be liberal within the current system.

"Slovenia is a land of contradictions, an Alpine paradise for pensioners with extremely hostile environment to the youth. They are enchained to be forced to pay high progressive taxes that don't take assets into account as well as they're compelled to high prices of real estate. They will sweat longer than current pensioners ever did, they will pay higher social security contributions and at the end they will receive lower pensions. Those who're thrown into the wheel of life without backup basis are only able to create wealth and welfare on their own account respectively. Closer they reach the point of their objectives, more they are pushed to the ground with progressive taxes. The outcome of "socially egalitarian" order is that people spend more time on the workplace and rarely decide to start taking care of themselves as well as they rarely decide to start creating their own families ... And remember, if you're a liberally minded individual living in Slovenia, don't get despaired. Instead, keep on finding the way of how to be liberal within the current system.

Friday, October 06, 2006

ITALY'S TAX HIKE

It seems Italy's going to plunge into another serious economic downturn by increasing income tax rates. The country is captured by a fairly unstable macroeconomic situation. Public debt (measured as a percentage of GDP) is the highest in the Union. Italian leftist policymakers chose to cut country's 4,2% budget deficit by increasing tax rates instead of cutting spending habits. Although the budget reduces payroll taxes by EUR6bn in 2007 and EUR9bn in 2008, income taxes are raised immediately by EUR33.4bn, mostly through an increase in the top rate of tax from 41% to 43%, and lowering the floor for the top rate from EUR100,000 to EUR75,000. Lower bands are adjusted to favour the less well-off. This amounts to a savage attack on the middle classes, and is presumably exactly the opposite of what needs to be done if Italians' notorious under-declaration of tax is to be brought under control. Prodi announced measures to punish professionals who don't declare all their income; but successive governments have totally failed in this endeavour and there's no reason to think that the new one will be any more successful. It is completely impossible to create economic growth by increasing taxes and uncutting government spending. Italian general economic picture is everything else but favorable. IMD ranked Italy's Competitveness even below its neighbour Slovenia. Foreign investors face enormous restrictions on operations and ownership as well. Economic freedom of Italy is miserable. Together with France, the country's economic freedom has been kicked-off far below the level of the most competitive economies. Fiscal deficit is huge. Labor market amount indispensable rigidies that produce difficult practices of hiring and firing workers. It takes more than 500 hundred days to enforce contracts while venture capital funds are rarely availible. New tax increases proposed by Prodi's government will make this problematic situation even worse off.

Monday, October 02, 2006

Wednesday, September 27, 2006

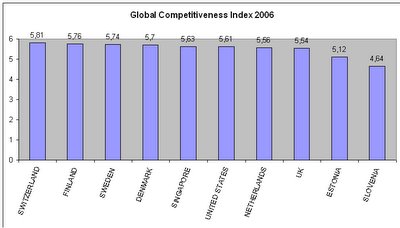

WORLD ECONOMIC FORUM: GLOBAL COMPETITIVENESS INDEX 2006

This year's Global Competitiveness Index surprised many economists, managers, researchers, scholars and other people as well. Two years ago nobody could think of Swiss economic tiger on top of the Global Competitiveness Index issued by World Economic Forum.

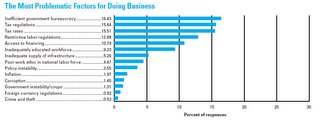

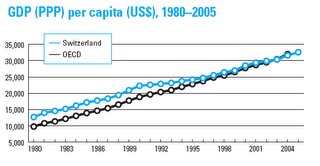

Switzerland is truly the embodiment of the success story. The country has preserved its political neutrality for a long time. Aided by peace and neutrality Switzerland had almost no problems in facing challenges in the global economy. The country's institutional order is very sufficient in terms of protecting everyone's wealth and income when he enters the market. Milton Friedman, Gary Becker and Douglass North have defined solid protection of private property rights as a key element of the economic freedom. Heritage Foundation's Index of Economic Freedom firmly placed Switzerland among the freest economies in the world. Long years of stable politics and stable currency, relatively low taxes, secure financial system and many incentives for incoming investors have made Switzerland an attractive investment destination especially for small manufacturing firms. Larger businesses are internationally highly competitive while agricultural businesses are small and economic policy has insisted on largely protecting them from foriegn competition.

Despite of brilliant innovation performance, Swiss consensus-driven business and political system retard further economic growth. Similar distorsions could be seen in Germany, Italy, Austria and Slovenia. Several years ago, Switzerland has announced its intention to pursue free trade agreement with the United States. We hope that this comes true. Switzerland favors a moderate trade policy, far from being a protectionalist economy. Only restrictive agricultural trade policy is varying aside from this. Nearly all agricultural products are subject to strict import duties and variable quotas. Protectionist agricultural trade policy lowers the level of Swiss economic globalization. Relatively low taxes are an important aspect of producing incentives to acelerate more productive behavior and efforts in order to work, save and invest. Current top cantonal income tax rates is 35% while top cantonal corporate tax rate is equal to 23%.

A little bit worrying is unusually high public expediture rate (36% of the GDP) setup by the government. Bernanke, Mishkin, Laubach and Posen (1999) report that Switzerland adopted inflation targeting in December 1974. The desire of the monetary policy was to coordinate the inflation expectations of the public with policy objectives of the central banks. Monetary targeting has been quite flexible in practice. Switzerland announced a point target which arguably doesn't give the public the false impression that money is controllable over a narrow range. At the beginning og 1975 Switzerland was about to enter the worst recession in postwar history. The oil shock had triggered a downturn that must already have been under way. Although the Swiss franc helped to absorb the inflationary impact of the shock, that impact posed a serious threat to the Swiss export sector, which constituted about a third of GNP at the time. During 1975 exports of merchandise fell by 8% in real terms. Moreover, though subdued growth in real wages supported the Bank's fight against acelerated inflation, it also contributed to a sharp decline in real consumption which was worsened by a significant outflow of foreign workers. The money-targeting initiative did nothing to ease the high costs of Switzerland's disinflatio, nor did the Bank suggest that the targeting would provide a coordinating function for wage- and price-setters that would lower that cost. The adoption of a target was intended to cap inflation expectations by indicating a policy commitment and nothing else. Today Switzerland's annual rate of inflation from 1995-2004 is 0,77 percent.

Institutionally, Switzerland may be one of the best protectors of private property rights due to secure contratual agreements and high quality judiciary. According to World Bank, it takes 22 procedures, 215 days to enforce contracts on the whole. The cost of enforcing contracts is 11 percent of the debt which ranks Switzerland on the 9th place according to the flexibility of enforcing contracts. Switzerland is very open to foreign investment with some restrictions on ownership participation in certain sectors as well. Banking system is secure and offers a wide variety of financial products. Approving credits and loans is allocated on market terms. Aside from extensive regulation practices, informal business sector participation rate is among the lowest in the world according to Transparency International.

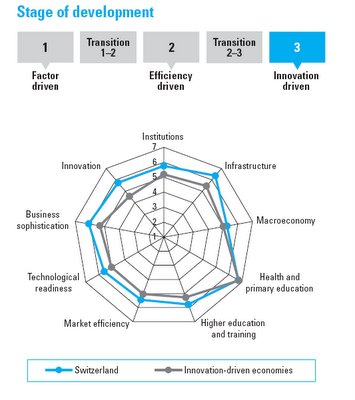

Components that led Switzerland to the top of Global Competitiveness Index were performed successfully. Infrastructure is one of the most sophisticated in the world. It presents one of the foremost requirements for good conditions in order to pursue economic growth and long-term economic development. Macroeconomic picture is a little bit off the anchor but macroeconomic forecasts for the future predict improvement in that way. Higher Education and training institutions offer excellent education opportunities while the cooperation between universities and economy returns profitably and produces excellent output in terms of knowledgeable achivements. Market efficiency and efficiency enhancers successfully derive the problem of business sophistication, as well as of technological readiness.

Other countries showed randomly mixed performance. Traditionally competitive Nordic economies scored very well. Sweden and Finland topped right behind Switzerland. The main drivers of Nordic formula for success are a very sound financial system, strong protection of private property rights, quickly enforced contracts, high R&D expeditures, excellent education system, technological readiness and above-averaged rate of market efficiency and other efficiency enhancers.

Read more:

WEF, Global Competitiveness Index 2006,

Forbes, Global Competitiveness Rankings,

Forbes, The World's Most Competitive Countries 2006,

International Investing Guide

Subscribe to:

Posts (Atom)