Tuesday, February 21, 2006

GROWTH, JOBS, SIMPLICITY, FAIRNESS AND PROSPERITY: PANEL ON TAX REFORM - THE CASE OF THE U.S. and SLOVENIA

Traditionally, there's a basic aspect that the U.S. and Slovenia have benefited from their process of "tax competition". But there's certain evidence that America and Slovenia are falling behind with their progressively imposed system of taxes. Nations around the world are skipping forward with lower tax rates and reformed tax systems. Indeed, several nations from Eastern Europe impose genuinely adopted versions of flat tax. Estonia was the first to make such an encourages step ahead in 1994. Her incredible metamorphosis from a Soviet-type of economy to a free-market economy was namely a result of seriously principled reforms, launched by Estonian Prime Minister Mart Laar in the early 1990s. Slovakia is the most recent country that followed liberally traced principles, by adopting 19% flat tax on corporate and personal income. Slovakian reforms (Martin Bruncko, Ivan Miklos...) put an emphasis on replacing the old system that included 90 exceptions, 19 sources of untaxed income, 66 tax-exempt items and 27 items with specific tax rates.Unlike the present system, the flat tax is far more efficient and simple, good for growth and suitable for creating new jobs. Instead of ("cane-filling-crap") the 893 forms of tax cards, the flat tax is proposed on two postcard-sized forms, one for labor income and another one for business and capital income. Instead of discriminating treating, the flat tax treats all tax-payers equally, thus certainly fulfilling "Justitia omnibus" or "Equal Justice for all", most prominently etched echo of the legal code. Unlike the present system that punishes productive citizens who contribute much to nation's growth, the system of flat tax lowers marginal tax rates and most importantly eliminates tax bias against productive behavior, such as saving and investment, thus ensuring better and more explosive economic performance in competitive global economy. Admirably, there have been "blueprint" path-breaking attempts to launch the idea of flat, proposed by Hoover Institution economists, namely Alvin Rabushka and Robert E. Hall. While differently proposed, all common flat tax features sustain fixed elements that put equal treating of all taxpayers, simplicity and fairness ahead of unequal and discriminative treatment of tax-payers - a system that indicates that some of the individuals are worth more and some are worth less. Under flat tax, such a violent tax-discrimination would be endlessly abolished. So let me turn to the point of basic features that are proposed with the idea of single flat tax rate.1. SINGLE AND LOW FLAT RATE. German professor of Economics & Finance at Heidelberg University argues that no flat tax should be higher than 25%. Putting the reality on the table, all flat tax rates propose less than 20% flat rates. The low flat rates solve the problem of high marginal income rates that penalize courage and productive behavior, namely work, risk-taking and entrepreneurship.2. FAST ELIMINATION OF SPECIALLY TREATED PREFERENCES. All of the flat tax prosposal eliminate provisions of the code that bestow preferential tax treatment on certain behavior and activities. By getting rid of tax deductions, credits, exemptions and other "loopholes", the elimination of special preferences solves the problem of rigid complexity, allowing individual tax-payers to file their tax return on two postcard-sized forms.3. NO MORE DOUBLE TAXATIONS OF SAVINGS AND INVESTMENTS. Simply imposed flat tax proposals eliminate the tax code's bias against the formation of capital, by complete ending of double-taxation of income that is both, saved and invested. This of course means that there would be no capital gains tax, no double taxes on saving and no double taxes on dividends. By taxing income only once, it will be easier under flat tax to enforce and more conducive to both, job and capital formation.4. THE PRINCIPLE OF TERRITORIAL TAXATION. Certain flat tax proposals are based on the notion of "territorial taxation", simply meaning that governments should only tax income that has been gained inside (within) national borders. By getting rid of "worldwide taxation", a flat will enable U.S. and Slovenian taxpayers and companies to perform competitively on a level playing field around the world, since many other nations already rely on these principles.5. FAMILY-FRIENDLY NATURE OF FLAT TAX. There's another prosperous aspect that firmly underpins, why the flat tax is better than progressive tax rates. Households receive a generous exemption based on family size. In the case of U.S., a family of four would not start to pay tax until their annual income would overreach the annual income of $30 000.GROWTHFULLY SUSTAINABLE ADVANTAGES OF A FLAT TAXMost recently told, there are two most principal arguments for a flat tax rates. The first one is growth and the second one is simplicity. Many "supply-side" economists are literally attracted to the idea of a flat tax, because the current system is relied on high rates and discriminatory taxation of savings and investment, reduced growth, destroyed (non-value added) jobs and lower incomes. Lower incomes are stolen to certain individuals and are transmitted to preferred groups (lobbies), that a regular citizen can never hope to be in such a firm position, where he would receive incomes that were stolen from other individuals that kept on hard working in order to earn as much money as possible to save it for his or her family. A flat tax wouldn't eliminated the damaging impact of all taxes together; but by dramatically lowering rates and ending the tax code's bias against saving and investment, it would boost the economy's performance when compared with the present tax code.For many Slovenians and Americans, the most prospective feature of a flat tax is its simplicity. The complicated documents and manual instructions taxpayers struggle to decipher from every March to October would be replaced by a brief set of instructions and the numerous forms by two simple postcards. This radical and prosperous reform appeals to citizens who not only resent the time and expense consumed by their own tax forms, but also suspect that the existing maze of credits, deductions, and exemptions gives a special and discriminatory advantage to those wield political power and can afford expert tax advisers.If I come to end and enact certain advantages for Slovenia and the U.S. by imposing a single flat tax rate on labor and capital. A FLAT TAX WOULD YIELD MAJOR BENEFITS TO THE NATION, INCLUDING:- FASTER, RAPID AND EXPLOSIVE ECONOMIC GROWTH. A flat tax would spur increased work, saving and investment. By increasing incentives to be engaged in productive-type of economic behavior, it would also (most centrally) boost the economy's engine for long-term growth rate. Even if a flat tax boosted long-term economic growth, by as little as 0,5%, the income of the average family of four after the period of 10 years would still be as much as $5 000 higher that it would be under present system of "tax misery", in case if current tax laws remained in effect.- INSTANT WEALTH CREATION. Harvard economist, Dale Jorgensen says that "tax reform would boost American national wealth by nearly a $5 trillion. The reason for that argument is that all income producing assets would raise in value since the flat tax increase the after-tax system if income they actually generate.To boost growth rate, to create more jobs, to attain tax simplicity, to pursue more liberty, economic prosperity in order to preserve equal treatment for all taxpayers, to reduce political abuses and to cut the influence of lobbies on tax, there's an emerging enquiry to boost nation's economic performance in global economy. If we hold inalienable truths, that all men are created equal, as self-evident as there's a fair deal that must adopt flat tax rate and end progressive rates, that pursue misery, unhappiness and economic devolution. Such a negative aspects would most certainly devastate the nation's growth and bright future that is enacted in the proposal of a flat tax.

Sunday, February 19, 2006

HISTORY BROADENS THE MIND: AN APPLICABLE CONTRIBUTION TO THE GOSPEL OF AMERICA'S COMMITMENT TO FREEDOM

"But when a long Train of Abuses and Usurpations, pursuing invariably the same Object, evinces a Design to reduce them under absolute Despotism, it is their Right, it is their Duty, to throw off such Government, and to provide new Guards for their future Security."

The Declaration of Independence

"We the People of the United States, in Order to form a more perfect Union, establish Justice, insure domestic Tranquility, provide for the common defence, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity, do ordain and establish this Constitution for the United States of America..."

The Constitution of the United States of America

'Tis folly in one Nation to look for disinterested favors from another; that it must pay with a portion of its Independence for whatever it may accept under that character; that by such acceptance, it may place itself in the condition of having given equivalents for nominal favours and yet of being reproached with ingratitude for not giving more. There can be no greater error than to expect, or calculate upon real favours from Nation to Nation. 'Tis an illusion which experience must cure, which a just pride ought to discard.

George Washington, Farewell Address, September 19, 1796

A people... who are possessed of the spirit of commerce, who see and who will pursue their advantages may achieve almost anything.

George Washington, letter to Benjamin Harrison, October 10, 1784

Harmony, liberal intercourse with all Nations, are recommended by policy, humanity and interest. But even our Commercial policy should hold an equal and impartial hand: neither seeking nor granting exclusive favours or preferences; consulting the natural course of things; diffusing and diversifying by gentle means the streams of Commerce, but forcing nothing; establishing with Powers so disposed; in order to give trade a stable course.

George Washington, Farewell Address, September 19, 1796

In proportion as the structure of a government gives force to public opinion, it is essential that public opinion should be enlightened.

George Washington, Farewell Address, September 19, 1796

Knowledge is, in every country, the surest basis of public happiness.

George Washington, First Annual Message, January 8, 1790

No taxes can be devised which are not more or less inconvenient and unpleasant.

George Washington, Farewell Address, September 19, 1796

Observe good faith and justice towards all Nations. Cultivate peace and harmony with all.

George Washington, Farewell Address, September 19, 1796

The value of liberty was thus enhanced in our estimation by the difficulty of its attainment, and the worth of characters appreciated by the trial of adversity.

George Washington, letter to the people of South Carolina, Circa 1790

There exists in the economy and course of nature, an indissoluble union between virtue and happiness; between duty and advantage; between the genuine maxims of an honest and magnanimous policy, and the solid rewards of public prosperity and felicity; since we ought to be no less persuaded that the propitious smiles of Heaven can never be expected on a nation that disregards the eternal rules of order and right, which Heaven itself has ordained.

George Washington, First Inaugural Address, April 30, 1789

Tis substantially true, that virtue or morality is a necessary spring of popular government. The rule indeed extends with more or less force to every species of free Government.

George Washington, Farewell Address, September 19, 1796

Human nature itself is evermore an advocate for liberty. There is also in human nature a resentment of injury, and indignation against wrong. A love of truth and a veneration of virtue. These amiable passions, are the "latent spark"... If the people are capable of understanding, seeing and feeling the differences between true and false, right and wrong, virtue and vice, to what better principle can the friends of mankind apply than to the sense of this difference?

John Adams, the Novanglus, 1775

Government is instituted for the common good; for the protection, safety, prosperity, and happiness of the people; and not for profit, honor, or private interest of any one man, family, or class of men; therefore, the people alone have an incontestable, unalienable, and indefeasible right to institute government; and to reform, alter, or totally change the same, when their protection, safety, prosperity, and happiness require it.

John Adams, Thoughts on Government, 1776

Each individual of the society has a right to be protected by it in the enjoyment of his life, liberty, and property, according to standing laws. He is obliged, consequently, to contribute his share to the expense of this protection; and to give his personal service, or an equivalent, when necessary. But no part of the property of any individual can, with justice, be taken from him, or applied to public uses, without his own consent, or that of the representative body of the people. In fine, the people of this commonwealth are not controllable by any other laws than those to which their constitutional representative body have given their consent.

John Adams, Thoughts on Government, 1776

Children should be educated and instructed in the principles of freedom.

John Adams, Defense of the Constitutions, 1787

But a Constitution of Government once changed from Freedom, can never be restored. Liberty, once lost, is lost forever.

John Adams, letter to Abigail Adams, July 17, 1775

As long as Property exists, it will accumulate in Individuals and Families. As long as Marriage exists, Knowledge, Property and Influence will accumulate in Families.

John Adams, letter to Thomas Jefferson, July 16, 1814

A constitution founded on these principles introduces knowledge among the people, and inspires them with a conscious dignity becoming freemen; a general emulation takes place, which causes good humor, sociability, good manners, and good morals to be general. That elevation of sentiment inspired by such a government, makes the common people brave and enterprising. That ambition which is inspired by it makes them sober, industrious, and frugal.

John Adams, Thoughts on Government, 1776

As good government is an empire of laws, how shall your laws be made? In a large society, inhabiting an extensive country, it is impossible that the whole should assemble to make laws. The first necessary step, then, is to depute power from the many to a few of the most wise and good.

John Adams, Thoughts on Government, 1776

Wisdom and knowledge, as well as virtue, diffused generally among the body of the people, being necessary for the preservation of their rights and liberties, and as these depend on spreading the opportunities and advantages of education in the various parts of the country, and among the different orders of people, it shall be the duty of legislators and magistrates... to cherish the interest of literature and the sciences, and all seminaries of them.

John Adams, Thoughts on Government, 1776

A morsel of genuine history is a thing so rare as to be always valuable.

Thomas Jefferson, September 8, 1817

All eyes are opened, or opening, to the rights of man. The general spread of the light of science has already laid open to every view the palpable truth, that the mass of mankind has not been born with saddles on their backs, nor a favored few booted and spurred, ready to ride legitimately, by the grace of God.

Thomas Jefferson, letter to Roger C. Weightman, June 24, 1826

At the establishment of our constitutions, the judiciary bodies were supposed to be the most helpless and harmless members of the government. Experience, however, soon showed in what way they were to become the most dangerous; that the insufficiency of the means provided for their removal gave them a freehold and irresponsibility in office; that their decisions, seeming to concern individual suitors only, pass silent and unheeded by the public at large; that these decisions, nevertheless, become law by precedent, sapping, by little and little, the foundations of the constitution, and working its change by construction, before any one has perceived that that invisible and helpless worm has been busily employed in consuming its substance. In truth, man is not made to be trusted for life, if secured against all liability to account.

Thomas Jefferson, letter to Monsieur A. Coray, Oct 31, 1823

Equal and exact justice to all men, of whatever persuasion, religious or political.

Thomas Jefferson, First Inaugural Address, March 4, 1801

For example. If the system be established on basis of Income, and his just proportion on that scale has been already drawn from every one, to step into the field of Consumption, and tax special articles in that, as broadcloth or homespun, wine or whiskey, a coach or a wagon, is doubly taxing the same article. For that portion of Income with which these articles are purchased, having already paid its tax as Income, to pay another tax on the thing it purchased, is paying twice for the same thing; it is an aggrievance on the citizens who use these articles in exoneration of those who do not, contrary to the most sacred of the duties of a government, to do equal and impartial justice to all its citizens.

Thomas Jefferson, letter to Joseph Milligan, April 6, 1816

History by apprising [citizens] of the past will enable them to judge of the future; it will avail them of the experience of other times and other nations; it will qualify them as judges of the actions and designs of men; it will enable them to know ambition under every disguise it may assume; and knowing it, to defeat its views.

Thomas Jefferson, Notes on the State of Virginia, Query 14, 1781

I have sworn upon the altar of God, eternal hostility against every form of tyranny over the mind of man.

Thomas Jefferson, letter to Benjamin Rush, September 23, 1800

I think all the world would gain by setting commerce at perfect liberty.

Thomas Jefferson, July 7, 1785

If a nation expects to be ignorant — and free — in a state of civilization, it expects what never was and never will be.

Thomas Jefferson, letter to Colonel Charles Yancey, January 6, 1816

Is it the Fourth?

Thomas Jefferson, evening July 3; Jefferson died the next morning, July 4, 1826

It is not honorable to take mere legal advantage, when it happens to be contrary to justice.

Thomas Jefferson, Opinion on Debts Due to Soldiers, 1790

It is the duty of every good citizen to use all the opportunities which occur to him, for preserving documents relating to the history of our country.

Thomas Jefferson, letter to Hugh P. Taylor, October 4, 1823

It should be our endeavor to cultivate the peace and friendship of every nation.... Our interest will be to throw open the doors of commerce, and to knock off all its shackles, giving perfect freedom to all persons for the vent to whatever they may choose to bring into our ports, and asking the same in theirs.

Thomas Jefferson, Notes on the State of Virginia, Query 22, 1787

Natural rights [are] the objects for the protection of which society is formed and municipal laws established.

Thomas Jefferson, letter to James Monroe, 1791

No government ought to be without censors & where the press is free, no one ever will.

Thomas Jefferson, September 9, 1792

The boisterous sea of liberty is never without a wave.

Thomas Jefferson, letter to Richard Rush, October 20, 1820

The care of human life and happiness, and not their destruction, is the first and only legitimate object of good government.

Thomas Jefferson, letter to The Republican Citizens of Washington County, Maryland, March 31, 1809

The tree of liberty must be refreshed from time to time with the blood of patriots and tyrants. It is its natural manure.

Thomas Jefferson, letter to William Stephens Smith, November 13, 1787

An ELECTIVE DESPOTISM was not the government we fought for; but one which should not only be founded on free principles, but in which the powers of government should be so divided and balanced among several bodies of magistracy, as that no one could transcend their legal limits, without being effectually checked and restrained by the others.

James Madison, Federalist No. 48, February 1, 1788

Equal laws protecting equal rights — the best guarantee of loyalty and love of country.

James Madison, letter to Jacob de la Motta, August 1820

In Europe, charters of liberty have been granted by power. America has set the example ... of charters of power granted by liberty. This revolution in the practice of the world, may, with an honest praise, be pronounced the most triumphant epoch of its history, and the most consoling presage of its happiness.

James Madison, National Gazette Essay, January 18, 1792

No man is allowed to be a judge in his own cause, because his interest would certainly bias his judgment, and, not improbably, corrupt his integrity.

James Madison, Federalist No. 10, November 23, 1787

We have heard of the impious doctrine in the old world, that the people were made for kings, not kings for the people. Is the same doctrine to be revived in the new, in another shape — that the solid happiness of the people is to be sacrificed to the views of political institutions of a different form? It is too early for politicians to presume on our forgetting that the public good, the real welfare of the great body of the people, is the supreme object to be pursued; and that no form of government whatever has any other value than as it may be fitted for the attainment of this object.

James Madison, Federalist No. 45, January 26, 1788

As to Taxes, they are evidently inseparable from Government. It is impossible without them to pay the debts of the nation, to protect it from foreign danger, or to secure individuals from lawless violence and rapine.

Alexander Hamilton, Address to the Electors of the State of New York, March, 1801

History affords us many instances of the ruin of states, by the prosecution of measures ill suited to the temper and genius of their people. The ordaining of laws in favor of one part of the nation, to the prejudice and oppression of another, is certainly the most erroneous and mistaken policy. An equal dispensation of protection, rights, privileges, and advantages, is what every part is entitled to, and ought to enjoy... These measures never fail to create great and violent jealousies and animosities between the people favored and the people oppressed; whence a total separation of affections, interests, political obligations, and all manner of connections, by which the whole state is weakened.

Benjamin Franklin, Emblematical Representations, Circa 1774

Strangers are welcome because there is room enough for them all, and therefore the old Inhabitants are not jealous of them; the Laws protect them sufficiently so that they have no need of the Patronage of great Men; and every one will enjoy securely the Profits of his Industry. But if he does not bring a Fortune with him, he must work and be industrious to live.

Benjamin Franklin, Those Who Would Remove to America, February, 1784

Where liberty dwells, there is my country.

Benjamin Franklin (attributed), letter to Benjamin Vaughn, March 14, 1783

Without Freedom of Thought there can be no such Thing as Wisdom; and no such Thing as Public Liberty, without Freedom of Speech.

Benjamin Franklin, writing as Silence Dogood, No. 8, July 9, 1722

Society in every state is a blessing, but government, even in its best state, is but a necessary evil; in its worst state an intolerable one; for when we suffer or are exposed to the same miseries by a government, which we might expect in a country without government, our calamity is heightened by reflecting that we furnish the means by which we suffer.

Thomas Paine, Common Sense, 1776

Freedom had been hunted round the globe; reason was considered as rebellion; and the slavery of fear had made men afraid to think. But such is the irresistible nature of truth, that all it asks, and all it wants, is the liberty of appearing.

Thomas Paine, Rights of Man, 1791

This new world hath been the asylum for the persecuted lovers of civil and religious liberty from every part of Europe. Hither have they fled, not from the tender embraces of the mother, but from the cruelty of the monster; and it is so far true of England, that the same tyranny which drove the first emigrants from home, pursues their descendants still.

Thomas Paine, Common Sense, 1776

Saturday, February 18, 2006

ENSE PETIT LIBERTAM SUB PLACINDE QUIETEM: WHY IS THE SYSTEM OF COLLECTIVE BARGAINING DESTRUCTIVE TO GROWTH AND HARMFUL TO FREE SOCIETY?

It's widely believed that European "example-in-case" of Economic unsustainability will never reach so ever-wanted point, where Europe could become the most growthful Economy in the world. Such a wishful ambition is certainly welcoming. But sustaining current system of Economic destitution, where Europe is pretending itself to maintain such system in order to preserve its unique social system, which is and presumably remains unfit for command. So where's the problem that pushes Europe back. Following classical emphasis, the two main objectives are politically and economically underlayed. Let me first turn to the political issue. Europe has instituted one of the most beneficial systems of welfare through out the History of 20th century. Approximately until the mid-1970s Europe has been catching up with the United States quite instantly, according to economic results. But aftermath, European economic system began to decline rapidly and lagging behind the U.S. Economy. Several efforts lead Europe to such an unadmirable result. First far-reaching consequence is the lack of personal, social, economic and political irresponsibility. Such an intrinsic dimension of socioeconomic devolution was resulted according to European mind of uncritical social thinking that put income equality ahead of freedom, responsibility, growth, prosperity and happiness. But such devolution has been continuing to expand rapidly, after business managers that lead production began to become the hostage of lobbies and trade unions that insisted to impose 7-hour daily work time that reflected the very strong decline in entrepreneurial productivity. European trade unions forced largely expanding European businesses into appointing minimum wage, what made European labor market rigid and inflexible. Another crucially important aspect is that European trade unions insisted strongly to acclaim the promotion of an early retirement that replaced the burden of labor on the most productive individuals. Such a destructive effect of economic policy led to higher taxes. According to the Laffer curve, high taxes imposed on a smaller tax base, will not increase tax revenue, but sooner or later decrease. The most knowledgeable and productive individuals did therefore not accumulate a lot of their human capital, so the measured level of output capacity was lower than in the United States. That's how the most knowledgably recognized and prosperous individuals began to leave European misery and escape into the United States, where they much easily achieved what they seemed impossible to attain in Europe. The most obvious evidence of European economic destitution is seen in countries, such as France, Slovenia, Italy and Germany, also Sweden. Thus, according to Index of Economic Freedom (Heritage Foundation), France is the most bureaucratic monster in Europe. Very rigid labor market forced German investors to remove their production from Germany. Italian health and social security system is about to collapse sooner or later. Highly-regulated financial markets, unwelcoming approach to foreign investment, astronomic taxes, weak protection of private property, pro-rigid labor market and illiberal legislation made the richest of the post-communist economies, namely Slovenia, unattractive to invest. Slovenia's gradual approach to economic policy disabled strong and economic blueprint cooperation between the economy and science, based upon the innovative decision-making establishment. Ljubljana is a beautiful city, but unfortunately the tax system would leave you so little in your wallet, that could be very hardly to enjoy sightseeing, that is offered in Ljubljana.The very first approach to pull Europe out of its trapped misery is to reinstitute personal responsibility that will reward the application of knowledge in society. Speaking how Europe's economic performance is lagging behind, because its society is not based enough on knowledge, is actually funny. Therefore, European policy-makers need to cut government expenses by privatizing social security and health system. European type of public administration is "upside down". According to CATO's Economic freedom of the world 2003, Sweden and Slovenia, have the largest public administration in Europe. Market decisions must not be disturbed by trade unions. Therefore, European policy-makers must not allow trade unions to bargain about salaries and wages for thousands of individuals. It's morally unacceptable to let trade unions to impose decisions that are not resulted in accordance with market-based solution, but remain a political disrespectfulness. For avoiding the collapse, not politicians but entrepreneurial individuals must make decisions and trade unions should not be allowed to bargain and harm the Economic growth. In fact, the best social programs aren't not state subsidies, but only jobs. Political bargaining about salaries and collective contracts will always reduce an agenda for growing Europe, that was written by distinguished Andre Sapir and other distinguished economists. An agenda for growing Europe will hardly be possible, unless there will once be a construction of entrepreneurial philosophy and market decisions, that will put challenge and growth ahead of political misleading. The most suitable way of throwing off the lobbies is to cut the government and privatize pension system and reduce the size of the state into ultra minimal state, where individuals will be more responsible for what they do. At last but not least, there's another prosperously sustaining aspect that is required if Europe will want to rise for the challenge of the bright future. That aspect will be done when the Flat Tax will be imposed. Progressive taxes were elaborated and required in Marx's Communist Manifesto that subjected the worst case scenario of how European economy and society should function. Progressive taxes are harmful to the economy and ultimately enable political abuses, where lobbying is coded within differently imposed tax rates that hurt highly educated and productive individuals that represent the major source of economic growth and future sustainability. There's no accumulation without investment and vice versa. But to take seriously proposed step ahead, European leaders must (!) not allow lobbies and trade unions to be in the position of bargaining and taking destinies of millions of others in their hands. A free society, that I envision, consisting of knowledge, responsibilities, duties, rights, entrepreneurial initiative, rule of law and individual rights as the moral basis of society, I believe is a place of sovereign individuals where everyone, being free to choose, is enabled to move from the bottom to the top to make his or her dreams come true and therefore enjoy a fuller and happier joyfulness of life.

Friday, February 17, 2006

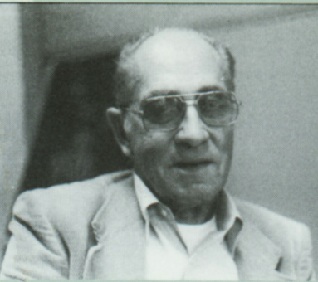

CONCEALED AND FORGOTTEN: CYRIL A. ZEBOT (1914 - 1989)

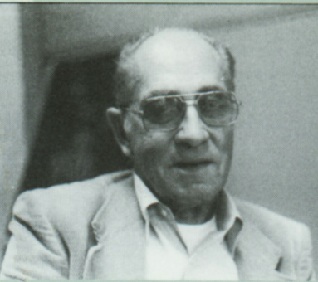

CYRIL A. ZEBOT

April 8, 1914 (Maribor, Slovenia) - January 11, 1989 (Washington D.C)

Cyril A. Zebot was born and raised in Maribor, Slovenia on April 8, 1914, right in the year when the world plunged into the most devastating war period of that time. His father Franjo Zebot was a vice mayor of Maribor and an imminent politician in the Kingdom of Serbs, Croats and Slovenes (Kingdom of Yugoslavia) on his deputy. Shortly after Germans invaded Slovenia the position of vice-mayor led Franjo Zebot to his arrest and later on sent him to prison. Young Cyril had very soon created his sociopolitical profile and common goals. In 1932 he graduated from the High School of Maribor (Classical Gymnasium Maribor). In 1936 he began studying law and became specialized in economics. After graduating at the University of Ljubljana, Cyril Zebot went on several education trips around Europe. He continued to study and attend specialization in economic sciences in Paris, Milan and Czechoslovak Republic. After coming back to Ljubljana in March 1941 he was appointed docent of economics at the University of Ljubljana. In Ljubljana, Cyril A. Zebot closely collaborated with prof. Lambert Ehrlich and they together prepared several papers concerning Slovenia's economic and political future. One of such mainstreams was so called "Intermarum", a community of independent and sovereign nations between Baltics and Adriatic. In May 1942, prof. Lambert Ehrlich was shot to death by the VOS (communist secret service), assassinated in the communist attempt on his life.. Ehrlich's murder was also the beginning of brutal civil war, inflamed by the Bolshevik movement. In September 1943, when Italy formally capitulated, Zebot withdrew to Rome and found sanctuary in the Vatican, after he learned that the Gestapo was looking for him. While staying in Rome, Zebot immediately organized a few initiatives in order to isolate Slovenia from Tito's socialism. At that time, a majority of allied nations was beginning to recognize, that Tito's Yugoslavia is nothing else but a Soviet-driven "puppet" of Stalin. Zebot worked together with native immigrants for an independent Slovenia addressed to Western allies. Prof. Zebot organized "Action Board for an independent Slovenia". The plan was very simple. The area around Trieste that was namely allied-driven area would became an independent state and soon after also other parts of Slovenia would be unified into independent Slovenia. After Slovenia was deliberately reannexed to Yugoslavia, prof. Zebot immigrated to the United States and became a prominent professor of economics at Duquesne University in Pittsburgh, PA. His academic performance was admired among American professors. Since 1958, prof. Zebot was holding lectures at Georgetown University in Washington D.C. He titled several books and papers that were recognized all across Western Europe and North America. His books, papers and articles were published in important New York-Washington newspapers, such as NY TIMES and WASHINGTON POST. In the latter alone, prof. Zebot published nearly 50 papers and articles that were issued in several publications.

THE ACADEMIC CAREER OF CYRIL A. ZEBOT IN ECONOMICS

After obtaining Bachelor’s degree in Economics & Law at the University of Ljubljana and finished specialization in economic sciences in Milan, Paris and Czechoslovak Republic, prof. Zebot, trained in both Economics and Law conducted various research works. In 1939 he published the book, entitled "Korporativna analiza narodnega gospodarstva" (Corporate Analysis of National Economy) which drew a reflection upon fascist-driven economy. The recent importance of that work was more than just a "few letters on the paper". The introduction of the book was written by prominent European economists Francesco Vito and Francois Perroux. The book was an "establishment of knowledge", that young Zebot instituted, when he was studying economic systems. His research performance could easily be compared with "state-of-the-art" Chicago authors. After coming back to Slovenia in 1939, prof. Zebot became employed in the Chamber of Labor. After promoting forward, prof. Zebot found an employment at the National Bank. In March 1941, prof. Zebot was the appointed docent of economics at the University of Ljubljana and since then he had been holding world-class lectures on economics at the Faculty of Law, at the University of Ljubljana. He issued his last book published in Slovenia at that time called "European Economic Perspectives" After immigrating overseas to the United States, prof. Zebot was an appointed professor of economics at the University of Duquesne in Pittsburgh, PA. In 1958, prof. Zebot found an employment at Georgetown University, Washington D.C. where he had been the appointed professor or Political Economy. On the 275th anniversary of Georgetown University Cyril A. Zebot had been a proud and "world-class" professor at Georgetown University in times when Bill Clinton studied Foreign Affairs there. He had been interested in such topics as integrated theory of inflation, convergence, economic growth, economic systems, economic perspectives, competition and economic coexistence. In 1964, prof. Zebot published "The Economics of Competitive Coexistence: Convergence through Growth", a masterpiece, that reflected upon economic courses within comparative economic systems. Since the very beginning of his Career, Cyril A. Zebot was a prominent part of "golden generation" of Slovenian economists, together with Alexander D. Bilimovich, Ljubo Sirc, Spektorski, Ogris and Eler. His excellent and world class lectures put an emphasis on the integrated theory of inflation in the United States, comparative economics and convergence through economic growth.

POLITICAL PATH OF CYRIL A. ZEBOT

The earliest political participation of Dr. Cyril A. Zebot was his very first membership of the academic club Straza v viharju ("Guards in the wind") that had been instituted upon the staunch anti-communist and pro-Slovene ideas of fulfilled Liberty. Zebot's academic club insisted strongly to oppose communist-driven coalition of Liberation front during the World War 2.

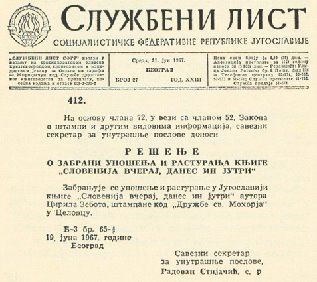

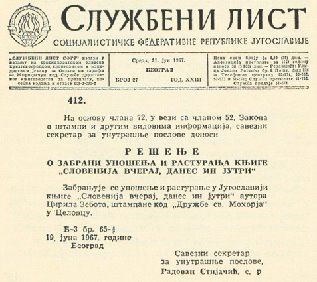

Page of the "Sluzbeni list" (Official Gazette) from Yugoslavia, dated June 21, 1967, whereby Belgrade prohibited to bring Zebot's book into Slovenia.

Consequently, Slovenia under the Communist regime of the great-Serbian Yugoslavia found itself indeed in the greatest state of emergency of its historical existence after WW2. The people in Slovenia, and also the leading Communist class were fully aware of this. However, it was impossible to speak out in a totalitarian Yugoslavia. And even among Slovenians of the free world, Prof. Zebot was one of the very few, who at that time knew and was aware of the critical situation in Slovenia. Against the threatening disappearance of Slovenians, he had no other tools but his visible rank, his great knowledge, and his pen.

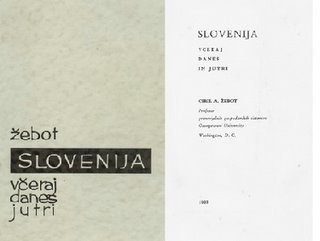

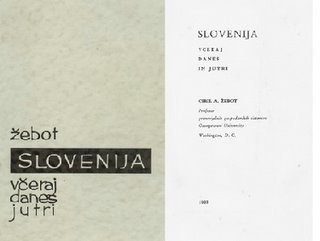

Cover and title page of Zebot's book "Slovenija, vceraj, danes, jutri" (Slovenia, yesterday, today, and tomorrow, 1967), which stirred up Slovenia and Yugoslavia at the end of the 60s.

Of course, his books, articles, and even the mentioning of his existence had to be suppressed in the then Slovenia. Besides, being a Catholic, who was teaching at an American university, his figure did not fit well in the Communist "scientific" mould, in sense of which the Faith should have been "opium for the people" (Marx). As a man of faith, Prof. Zebot should have been lagging behind, should have been ingenuous and incapable to understand the very social and economic process of development.

Actually, in the 60s no one in Slovenia believed in the Communist scientific "truth", but there were no examples of a different reality. Thus the fact must have been like a "divine finger" (as Slovenians say), when the knowledge of Prof. Zebot's figure and his endeavours for Slovenia were spread widely throughout the country. In 1967 Zebot's book "Slovenija, vceraj, danes, jutri" (Slovenia, yesterday, today, and tomorrow, 1967) was published by the Mohorjeva Publishing House in Klagenfurt - Celovec (Austria).

As already mentioned above, the bringing of the book into Yugoslavia was prohibited. But even the suppression provoked a great interest for it. Many people made a trip to Celovec (Austria) and brought the book secretly into Slovenia, like a kind of triumph. And the book was sold out in no time.

Among the young generation of Slovenian intellectuals, Zebot's analysis of the political and social situation of Slovenia of that time was very well accepted. It was said, he did not blindly attack Communism and Yugoslavia, albeit he critically took a standpoint toward the leading Communists, whom he called by name (Kardelj, Ribicic...). Prof. Zebot depicted the difficult situation of Slovenia, and in a constructive way he showed the salvation. After his prevision, the Slovenian Communist leaders themselves should have made a stop to the tremendous exploitation that went on in the autonomous Republic of Slovenia by sides of Belgrade.

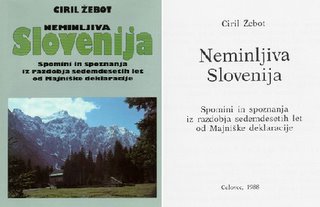

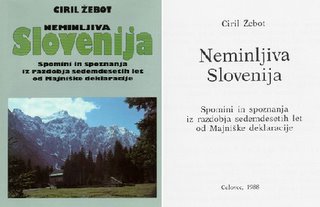

Zebot's last book "Neminljiva Slovenia" (Everlasting Slovenia, 1988), which could be considered his last will to the Slovenian people.

Prof. Zebot was watching the situation in Slovenia. In the second half of the 80s - during its greatest critical period since the existence of Yugoslavia - his new book called "Neminljiva Slovenia" (Everlasting Slovenia, 1988) was published in Klagenfurt - Celovec (Austria). In this book he quoted anew the Slovenian endeavours for a national identity, which started already since the WW1, and therefore he stated: Only a non-questionable sovereignty of the Republic of Slovenia must become a guarantee for an "Everlasting Slovenia" (p. 489).

In 1991, this message was finally carried out by the Slovenian ruling leadership with the day of the declaration of independence of Slovenia. It was the message, for which Prof. Ehrlich at the beginning of the WW2 was shot in an attempt on his life. Prof. Zebot did not live to see this, because he died in 1989. Some people tend to prefer to not remember him, but I think we should rather maintain and preserve his economic excellence, hard work and extensively knowledgeable literature, that were written by the man who was extremely talented in economics. But his talent was often turned into the struggle to survive in times of winding conditions and dark stages of the bloodiest century of the mankind.

April 8, 1914 (Maribor, Slovenia) - January 11, 1989 (Washington D.C)

Cyril A. Zebot was born and raised in Maribor, Slovenia on April 8, 1914, right in the year when the world plunged into the most devastating war period of that time. His father Franjo Zebot was a vice mayor of Maribor and an imminent politician in the Kingdom of Serbs, Croats and Slovenes (Kingdom of Yugoslavia) on his deputy. Shortly after Germans invaded Slovenia the position of vice-mayor led Franjo Zebot to his arrest and later on sent him to prison. Young Cyril had very soon created his sociopolitical profile and common goals. In 1932 he graduated from the High School of Maribor (Classical Gymnasium Maribor). In 1936 he began studying law and became specialized in economics. After graduating at the University of Ljubljana, Cyril Zebot went on several education trips around Europe. He continued to study and attend specialization in economic sciences in Paris, Milan and Czechoslovak Republic. After coming back to Ljubljana in March 1941 he was appointed docent of economics at the University of Ljubljana. In Ljubljana, Cyril A. Zebot closely collaborated with prof. Lambert Ehrlich and they together prepared several papers concerning Slovenia's economic and political future. One of such mainstreams was so called "Intermarum", a community of independent and sovereign nations between Baltics and Adriatic. In May 1942, prof. Lambert Ehrlich was shot to death by the VOS (communist secret service), assassinated in the communist attempt on his life.. Ehrlich's murder was also the beginning of brutal civil war, inflamed by the Bolshevik movement. In September 1943, when Italy formally capitulated, Zebot withdrew to Rome and found sanctuary in the Vatican, after he learned that the Gestapo was looking for him. While staying in Rome, Zebot immediately organized a few initiatives in order to isolate Slovenia from Tito's socialism. At that time, a majority of allied nations was beginning to recognize, that Tito's Yugoslavia is nothing else but a Soviet-driven "puppet" of Stalin. Zebot worked together with native immigrants for an independent Slovenia addressed to Western allies. Prof. Zebot organized "Action Board for an independent Slovenia". The plan was very simple. The area around Trieste that was namely allied-driven area would became an independent state and soon after also other parts of Slovenia would be unified into independent Slovenia. After Slovenia was deliberately reannexed to Yugoslavia, prof. Zebot immigrated to the United States and became a prominent professor of economics at Duquesne University in Pittsburgh, PA. His academic performance was admired among American professors. Since 1958, prof. Zebot was holding lectures at Georgetown University in Washington D.C. He titled several books and papers that were recognized all across Western Europe and North America. His books, papers and articles were published in important New York-Washington newspapers, such as NY TIMES and WASHINGTON POST. In the latter alone, prof. Zebot published nearly 50 papers and articles that were issued in several publications.

THE ACADEMIC CAREER OF CYRIL A. ZEBOT IN ECONOMICS

After obtaining Bachelor’s degree in Economics & Law at the University of Ljubljana and finished specialization in economic sciences in Milan, Paris and Czechoslovak Republic, prof. Zebot, trained in both Economics and Law conducted various research works. In 1939 he published the book, entitled "Korporativna analiza narodnega gospodarstva" (Corporate Analysis of National Economy) which drew a reflection upon fascist-driven economy. The recent importance of that work was more than just a "few letters on the paper". The introduction of the book was written by prominent European economists Francesco Vito and Francois Perroux. The book was an "establishment of knowledge", that young Zebot instituted, when he was studying economic systems. His research performance could easily be compared with "state-of-the-art" Chicago authors. After coming back to Slovenia in 1939, prof. Zebot became employed in the Chamber of Labor. After promoting forward, prof. Zebot found an employment at the National Bank. In March 1941, prof. Zebot was the appointed docent of economics at the University of Ljubljana and since then he had been holding world-class lectures on economics at the Faculty of Law, at the University of Ljubljana. He issued his last book published in Slovenia at that time called "European Economic Perspectives" After immigrating overseas to the United States, prof. Zebot was an appointed professor of economics at the University of Duquesne in Pittsburgh, PA. In 1958, prof. Zebot found an employment at Georgetown University, Washington D.C. where he had been the appointed professor or Political Economy. On the 275th anniversary of Georgetown University Cyril A. Zebot had been a proud and "world-class" professor at Georgetown University in times when Bill Clinton studied Foreign Affairs there. He had been interested in such topics as integrated theory of inflation, convergence, economic growth, economic systems, economic perspectives, competition and economic coexistence. In 1964, prof. Zebot published "The Economics of Competitive Coexistence: Convergence through Growth", a masterpiece, that reflected upon economic courses within comparative economic systems. Since the very beginning of his Career, Cyril A. Zebot was a prominent part of "golden generation" of Slovenian economists, together with Alexander D. Bilimovich, Ljubo Sirc, Spektorski, Ogris and Eler. His excellent and world class lectures put an emphasis on the integrated theory of inflation in the United States, comparative economics and convergence through economic growth.

POLITICAL PATH OF CYRIL A. ZEBOT

The earliest political participation of Dr. Cyril A. Zebot was his very first membership of the academic club Straza v viharju ("Guards in the wind") that had been instituted upon the staunch anti-communist and pro-Slovene ideas of fulfilled Liberty. Zebot's academic club insisted strongly to oppose communist-driven coalition of Liberation front during the World War 2.

Page of the "Sluzbeni list" (Official Gazette) from Yugoslavia, dated June 21, 1967, whereby Belgrade prohibited to bring Zebot's book into Slovenia.

Consequently, Slovenia under the Communist regime of the great-Serbian Yugoslavia found itself indeed in the greatest state of emergency of its historical existence after WW2. The people in Slovenia, and also the leading Communist class were fully aware of this. However, it was impossible to speak out in a totalitarian Yugoslavia. And even among Slovenians of the free world, Prof. Zebot was one of the very few, who at that time knew and was aware of the critical situation in Slovenia. Against the threatening disappearance of Slovenians, he had no other tools but his visible rank, his great knowledge, and his pen.

Cover and title page of Zebot's book "Slovenija, vceraj, danes, jutri" (Slovenia, yesterday, today, and tomorrow, 1967), which stirred up Slovenia and Yugoslavia at the end of the 60s.

Of course, his books, articles, and even the mentioning of his existence had to be suppressed in the then Slovenia. Besides, being a Catholic, who was teaching at an American university, his figure did not fit well in the Communist "scientific" mould, in sense of which the Faith should have been "opium for the people" (Marx). As a man of faith, Prof. Zebot should have been lagging behind, should have been ingenuous and incapable to understand the very social and economic process of development.

Actually, in the 60s no one in Slovenia believed in the Communist scientific "truth", but there were no examples of a different reality. Thus the fact must have been like a "divine finger" (as Slovenians say), when the knowledge of Prof. Zebot's figure and his endeavours for Slovenia were spread widely throughout the country. In 1967 Zebot's book "Slovenija, vceraj, danes, jutri" (Slovenia, yesterday, today, and tomorrow, 1967) was published by the Mohorjeva Publishing House in Klagenfurt - Celovec (Austria).

As already mentioned above, the bringing of the book into Yugoslavia was prohibited. But even the suppression provoked a great interest for it. Many people made a trip to Celovec (Austria) and brought the book secretly into Slovenia, like a kind of triumph. And the book was sold out in no time.

Among the young generation of Slovenian intellectuals, Zebot's analysis of the political and social situation of Slovenia of that time was very well accepted. It was said, he did not blindly attack Communism and Yugoslavia, albeit he critically took a standpoint toward the leading Communists, whom he called by name (Kardelj, Ribicic...). Prof. Zebot depicted the difficult situation of Slovenia, and in a constructive way he showed the salvation. After his prevision, the Slovenian Communist leaders themselves should have made a stop to the tremendous exploitation that went on in the autonomous Republic of Slovenia by sides of Belgrade.

Zebot's last book "Neminljiva Slovenia" (Everlasting Slovenia, 1988), which could be considered his last will to the Slovenian people.

Prof. Zebot was watching the situation in Slovenia. In the second half of the 80s - during its greatest critical period since the existence of Yugoslavia - his new book called "Neminljiva Slovenia" (Everlasting Slovenia, 1988) was published in Klagenfurt - Celovec (Austria). In this book he quoted anew the Slovenian endeavours for a national identity, which started already since the WW1, and therefore he stated: Only a non-questionable sovereignty of the Republic of Slovenia must become a guarantee for an "Everlasting Slovenia" (p. 489).

In 1991, this message was finally carried out by the Slovenian ruling leadership with the day of the declaration of independence of Slovenia. It was the message, for which Prof. Ehrlich at the beginning of the WW2 was shot in an attempt on his life. Prof. Zebot did not live to see this, because he died in 1989. Some people tend to prefer to not remember him, but I think we should rather maintain and preserve his economic excellence, hard work and extensively knowledgeable literature, that were written by the man who was extremely talented in economics. But his talent was often turned into the struggle to survive in times of winding conditions and dark stages of the bloodiest century of the mankind.

IN THE FACE OF EVIL: REAGAN'S WAR OF HEROISM IN WORD AND DEED

"When action is required to preserve our national security, we will act. We must act today in order to preserve tomorrow, and let there be no misunderstanding we are going to begin to act, beginning today."

Ronald Reagan

First Inaugural Address

He freed a billion slaves from their Communist masters... This is the story of that achievement: of one man’s triumph during the bloodiest and most barbaric century in mankind’s history: the 20th century.

In the Face of Evil: Reagan’s War in Word and Deed is a man and nation’s journey through the heart of darkness—and what that journey means for us today. This film is not a biography of Ronald Reagan, but a hard-hitting look at leadership and moral courage. Based on Peter Schweizer’s acclaimed bestseller, Reagan’s War, the new feature-length documentary film, In the Face of Evil, chronicles the brutal conflict between totalitarianism and freedom as seen through Ronald Reagan’s forty-year confrontation with Communism.

Reagan’s struggle began in direct conflict with Soviet-backed street-level violence during Communism’s attempt to take-over Hollywood during the 1940’s; it continued through his “wilderness years” on the mashed potato circuit in the 50’s, then on to his confrontation with the radicals at Berkeley in the 60’s showing, throughout, his challenge of the Establishment’s policy of détente, his steady rise to power, his rejection by his own party, and his focus on the need for a complete victory over Communism.

More than a traditional war film, In the Face of Evil plays out on an epic scale... from the back-lots of Hollywood, to the jungles of Central America; from the mountains of Afghanistan, to the palaces of the Kremlin; to the Brandenburg Gate in the heart of a divided Berlin...

“I have to believe that the history of this troubled century will indeed be redeemed in the eyes of God and man, and that freedom will truly come to all. For what injustice can withstand your strength?"

Ronald Reagan

Moscow, 1988

In the Face of Evil details, for the first time, with never-before-seen footage, the top-secret plans of Reagan and his inner circle ... and their brick-by-brick takedown of the “Evil Empire.”

... from the oil fields of Saudi Arabia to the streets of Warsaw; from the trading floors of Wall Street to the vast steppes of Siberia... the plan encompassed covert ops, a massive arms buildup, and economic and psychological warfare—all conducted on a scale never seen before.

With the world mired in the beginnings of a new global conflict, In the Face of Evil is more relevant today than ever. The film affords profound insights on the brutality of the last century, and offers a prism through which we can gain perspective on the bloody conflicts that stretch ahead.

“You and I have a rendezvous with destiny. We will preserve for our children this, the last best hope of man on earth...”

Ronald Reagan

1964

As the 21st century’s great conflict between freedom and Islamic Fascism takes shape, In the Face of Evil, and the words and deeds of Ronald Reagan, provide an invaluable lesson for how the U.S., and the free world, must combat the forces of Evil... if we are to survive.

Ronald Reagan

First Inaugural Address

He freed a billion slaves from their Communist masters... This is the story of that achievement: of one man’s triumph during the bloodiest and most barbaric century in mankind’s history: the 20th century.

In the Face of Evil: Reagan’s War in Word and Deed is a man and nation’s journey through the heart of darkness—and what that journey means for us today. This film is not a biography of Ronald Reagan, but a hard-hitting look at leadership and moral courage. Based on Peter Schweizer’s acclaimed bestseller, Reagan’s War, the new feature-length documentary film, In the Face of Evil, chronicles the brutal conflict between totalitarianism and freedom as seen through Ronald Reagan’s forty-year confrontation with Communism.

Reagan’s struggle began in direct conflict with Soviet-backed street-level violence during Communism’s attempt to take-over Hollywood during the 1940’s; it continued through his “wilderness years” on the mashed potato circuit in the 50’s, then on to his confrontation with the radicals at Berkeley in the 60’s showing, throughout, his challenge of the Establishment’s policy of détente, his steady rise to power, his rejection by his own party, and his focus on the need for a complete victory over Communism.

More than a traditional war film, In the Face of Evil plays out on an epic scale... from the back-lots of Hollywood, to the jungles of Central America; from the mountains of Afghanistan, to the palaces of the Kremlin; to the Brandenburg Gate in the heart of a divided Berlin...

“I have to believe that the history of this troubled century will indeed be redeemed in the eyes of God and man, and that freedom will truly come to all. For what injustice can withstand your strength?"

Ronald Reagan

Moscow, 1988

In the Face of Evil details, for the first time, with never-before-seen footage, the top-secret plans of Reagan and his inner circle ... and their brick-by-brick takedown of the “Evil Empire.”

... from the oil fields of Saudi Arabia to the streets of Warsaw; from the trading floors of Wall Street to the vast steppes of Siberia... the plan encompassed covert ops, a massive arms buildup, and economic and psychological warfare—all conducted on a scale never seen before.

With the world mired in the beginnings of a new global conflict, In the Face of Evil is more relevant today than ever. The film affords profound insights on the brutality of the last century, and offers a prism through which we can gain perspective on the bloody conflicts that stretch ahead.

“You and I have a rendezvous with destiny. We will preserve for our children this, the last best hope of man on earth...”

Ronald Reagan

1964

As the 21st century’s great conflict between freedom and Islamic Fascism takes shape, In the Face of Evil, and the words and deeds of Ronald Reagan, provide an invaluable lesson for how the U.S., and the free world, must combat the forces of Evil... if we are to survive.

Thursday, February 16, 2006

MAKING THE TAX SYSTEM MORE SIMPLE: ON THE PROGRESSIVITY OF TAXES

Various discussions and opened talks among economists wheatear the progressivity really matters for Economic growth and sustainable development, has uncovered some supposingly interesting predications and it gets really cool to see differently advanced economic analysis, concerning the progressivity of taxes. Going through extensive writings and working papers is much more deliverable and essentially effective then listening the leftists and their explosions of neosocialism about how the progressivity of taxes is inevitable. Such a negatively defective way of thinking and considering really has nothing to do with serious "Chicago Economics". So let me turn to the point of the progressivity of taxes and show my own view about it. The Relation between Tax Rates and Economic GrowthEffects of changes in economic growth is a considerable consequence of tax rates. More specifically, supply-side economist Arthur B. Laffer is accredited for offering one of the most convincing explanations on relation between tax rates and tax revenue. The following relation is also called namely "The Laffer Curve". To pursue the facts and correlations above, we need to construct the model of competitive equilibrium with heterogeneity of incomes and tax rates. As to economic growth, the production sector is holding two different sources of Economic Growth. The first source is basically known as "skilled workers" source of growth, while the other one is namely recognized after the portion of skilled labor force, that conducts R&D. Reducing the progressivity of taxes will have a long-running positive effect on changes in economic growth. If tax system is hopefully transformed and progressivity of taxes replaced with single marginal flat tax rate, then of course the progressivity will loose its basic effect on the consumption of human capital. The Flat Tax, namely recently described by Hall and Rabushka presents an experiment of transformation towards the calibrated system of single flat rates of taxes, that indices quantitative effects with an incredible measure of economic efficiency. Also the engine of economic growth has an essential effect on reducing the progressivity of taxes. Seen quantitatively, welfare "subsidies" are undoubtedly higher in the system, where comparative effects reduce the progressivity of taxes and therefore increase the economic efficiency, what actually gives wings to the Economy. In terms of transition costs towards growth equilibrium, more productive individuals rather prefer the system of flat tax rates.Basics and Theoretical ExhibitionLower tax rates increase economic growth. Bob Lucas (1990) applied an endogenous model where human capital is the most central engine of economic growth. In fact tax rates have a long-term quantitatively trivial effect on economic growth. Stokey and Rebello (1995) implied the general model of endogenous economic growth and effective parameters in quantitatively defined direction, where changes in tax rates are oftenly reduced in order to enable the accumulation of human capital and put it into practice. Stokey and Rebello also isolated those effects of quantitative analysis. By implying the "cross country" model of parallel regressions and numerical stimulations, there're considerable influenced implications of taxes on economic growth.Bob Lucas defined that quantitative effects of cutting taxes and reducing its progressivity are present in the model of human capital accumulation, and there's a certain extent on the beneficial and cost side of marginal conditions, known as "decision making". In case of sweepingly established progressivity of taxes, there's a huge influence on the accumulation of human capital. If X in skilled and reasonably productive, then the accumulation of his human capital would increase his purchase power and he'd be tax progressively and therefore he would not be willing to apply larger quantity of accumulated human capital. On the other hand, if the accumulation of human capital is running in the presence of liquidity constraints, then of course the progressivity will reasonably cut the tax burden of the poor, but aftermath the weight of tax burden would be transferred to those who attain high level of productivity and that would definitely present a stoppable effect of putting human capital in practice. Progressive tax rates potentially reduce the consumption of human capital that remains a major part of total factor productivity. The issue of tax progressivity is also a suitable theoretical exhibition. In the OG model, skilled and unskilled workers consume their resources to pay the education for their children. An amount of capable household participants is a key endogenous variable and it presents a value of skills that include endogenously based accumulations of human capital and decisions on the human capital investment. The portion of the workers, employed in R&D attains insightful results on aggregate effects of tax progressivity. Indeed, shifting tax progressivity has importantly implied changes even in specific situations, where the system of tax progressivity is replaced with one single model of proportionally marginal flat tax rate. The welfare under flat tax conditions is not reduced, but furthermore increased, because welfare is in fact an economic agent. The engine of economic growth contains a considerable effect on reshifting or exposing an increased level of the progressivity of taxes, by imposing an external effect and by increasing prices. The engine of economic growth is far more reliable, when tax burden is rapidly reduced, because technological structures will be able to be adopted more easily and dynamically.Writings and discussion, concerning the progressivity of taxes1. Gallorand Tsildon(1997) analyzed important connections of economic mobility, inequality and growth in the general model of capable heterogeneity. Gallor and Tsildon applied the linearity of the human capital function at the same spot in order to simplify the process of aggregation.2. Caucott, Imrohoglu and Kumar (2003) used a simple limit of twin-tracked heterogenesis in order to make the system of aggregation of the human capital more capable on responding to different effects of changes and reshifting shocks, that were primarily described by Andrade (1998).3. Uhlig and Yangama (1996) built the heterogenesis into Overlapping Generations model (OG Model), putting an argument, that shifting outcome capita. tax rates will enable young people to put an emphasis on saving, ahead.4. Blackeneau and Ingram (1999) considered the taxation of differently skilled workers at different tax rates, because there's also "so called " "skill-biased technological change". Blackeneau and Ingram charactirzed specific condtions of the influence of taxing older population according to higher tax rate. This method increases saving of those, whose personal incomes are taxed less, according to reshiftings in tax progressivity. The final effect therefore remains the increase of skilled labor on the labor market. In the following terms, the progressivity is implied functionally through physical capital. Blackeneu and Ingram put an emphasis on the relation-type condition between "capital" and "accumulation", arguing that the whole process holds a secondary imposed role, because the progressivity is reflected directly upon the capital return rate and has a negative effect on the supply of skilled labor. Blackeneu and Ingram hadn't faced the model of endogenous growth.5. Cassou and Lansing (2000) emphasized the local concept of migration regime and the system of marginal flat tax rate according to response functions of growth effects of shifting from progressive towards flat tax rate. Lower progressivity therefore increases the supply of productively skilled labor force, output, investment etc. Cassout and Lansing argue that untaxed earnings present the largest input of the human capital production in increase. They solved a special representative model and configured the progressivity with certain specification of tax rates as an increasing function of income. To understand the implicit inequality, it's central to conduct the scale-model of inequality explicitly separated.6. Caucott, Imrohoglu and Kumar (2003) resolved a special model of specific heterogeneity as a model agent, where inequality is developed according to the process of endogenous concept of capital. Such model can contain certain exogenous shocks of the recent effect of progressivity and premium precise, while representative model is not capable of conducting such issues properly.Calculating the effects of growth on progressivity by imposing a marginal condition (Lucon, 1990) is very similar to some explicit extent. The effects of change are important and require reduced or eliminated progressivity, which should be permanently replaced with the model of one single flat tax rates. But more concise research is reflected upon the model of fully-specific heterogeneous agents.

SUSTAINING PROSPERITY, GROWTH AND HAPPINESS: WHY IS CAPITALISM THE BEST HOPE FOR MAN ON EARTH?

"A major source of objection to a free economy is precisely that group thinks they ought to want. Underlying most arguments against the free market is a lack of belief in freedom itself. "

Milton Friedman

Aggressively performed attainment, battling against the course of free economy is most certainly placed among the most threatining forces of evil-minded philosophy, that claims to achieve state-sacrifying characters that would be standing ready to perish their sourceful freedom to fulfil the project of unprosperity and devastating environment, where individual sovereignity should not exist anymore longer.

Capitalist revolution was launched for guaranteeing Personal and Economic Freedom. Since then, individuals felt free to establish their own business, go to elections, participate freely in expressing opinions and certain views. The fundamental moral principle upon which capitalism is based is that individuals have inalienable rights and that governments exist solely to protect those rights. Capitalism requires the limiting of governmental power to maximize the freedom of the individual.

Capitalism as the most fulfillingly participated system has brought prosperity and freedom to all men around the world. In Europe, capitalism ended feudalism, the dictatorship of the aristocracy. In America, the principle of individual rights impelled the British colonists to throw off the rule of the monarchy and establish history’s freest nation – and the logic of the country’s founding principles led, in less than a century, to the abolition of slavery, a practice that existed everywhere in the world through all of history, and one still practiced widely today throughout the non-capitalist world. In post-World War II Japan, under America’s influence, a semi-capitalist, vastly freer society replaced the military dictatorship that preceded it. In Hong Kong, Taiwan and South Korea, the freedom of their capitalist or semi-capitalist systems enabled those countries (or colonies) to become havens for millions of refugees fleeing Communist oppression.

More broadly, capitalism brought freedom to millions of immigrants, coming overseas, successfully attempting to find their success and happiness, because they often felt politically or religiously persecuted. The most vivid distinction between the freedom, provided by capitalism and devolution entailed by socialism was seen in 20th century Berlin. Commercially prosperous and modern center of freedom West Berlin, and destitutionally squalid East Berlin prefectly reflected the difference between "western freedom" and "eastern misery". As most viably proud, America has been a hoping destintation for millions all over the world. Jews from Europe, Irish people, and escaping immigrants from Eastern Europe, who ran ahead towards the fulfillment of their dreams in a place, where only the sky is limited. Regarding the empirical correlation between economic freedom, i.e., capitalism and prosperity: the Heritage Foundation and the Wall Street Journal jointly publish an annual survey examining the degree of economic freedom in the world. Its title is the Index of Economic Freedom. “The story that the Index continues to tell is that economically freer countries tend to have higher per capita incomes than less free countries… The more economic freedom a country has, the higher its per capita income is.” The editors organize 155 countries into four categories, which are, in ascending order – repressed, mostly unfree, mostly free and free. “Once an economy moves from the mostly unfree category to the mostly free category, per capita income increases nearly four times.”

Statism in its all forms is the most suitable case of appalling destitution. Its origins and institutional creation inevitably lead themselves to destruction. Most formally represented premises of different types of statism are most definately connected into the twilight of misery, where private initiative, private property, non-regulation and business and critically exposed thinking will never take part as a recognized value system. So, today govrenment is not a solution to our problem, government is the problem. It's a problem that will never learn anything positive, from its most recent mistakes. Under statism, governments never learn, only people do. Capitalism as a free road ahead towards the attainment of human nature will eventually triumph. Should "statist" countries ask themselves, why there's such a degree of informal market. According to Milton Friedman, "The black market was a way of getting around government controls. It was a way of enabling the free market to work. It was a way of opening up, enabling people." In fact, state should never be a place of "never-ending allocating budget resources" to certain "interest groups", that leads themselves in position to argue, but they were not elected officials and they don't have any of the exclusive rights, so be put in charge and negotitiate about the destiny of hundreds and thosands of others.

Free market is the best way to ensure openness and set ambitions, visions and dreams, while a person that sees no vision will never be able to realize any of his high hopes or fulfil any of his or her dreams. Such a destructive system of instability and unthoughtful devolution will envitably lead such a way of thinking to collapse and downfall. An institutional case of such misery is "so called" neosocialism, that puts high taxes, intensive regulation and splashed bureaucracy ahead of simplicity and ultraminimal concept of the state (see: Rothbard). Such sort of society will inevitable fall upon the darkest stage of economic destitution.

According to the heritage of the History, Capitalism always let every individual to be free - free to go anywhere he wanted, free to live anyhow he desired and free to choose whatever he actually wanted. Philosophically most forward-seeing and sophisticated thinker, such as Milton Friedman, Ludwig von Mises, F.A. Hayek, Robert Nozick, Randy Barnett, Jan Narveson, Richard Epstein, Ayn Rand, always rallied around the pillar of Liberty and Victory, when they had been showing that individual prosperity and free market capitalism morally and guidingly have no credible alternatives, because such alternatives, like "trade-unionism", "collectivism", "neosocialism" lead to detained degree of destitutional separation.

So let us always aware that authority is not coming from the top to the bottom. It comes from the bottom to the top. If we removed all the concepts of political and economical philosophy from European discourse, only anti-americanism would remain left. Anti-americanism is not an ideology, it's a modern European way of life, that is being used to equipe Europe's identity. What kind of identity does Europe have? It should feel embarrased, according to the fact that millions of immigrants escaped from ideologies of evil and totalitarian oppression.

Here I suggest 10 most valueable and meaningful points, that should be placed ahead and unified in a consice value system of free-market society:

1. Goverments are instituted among men whose power derives from the consent of the governed.

2. The best social program is a job.

3. The most socially natured system of human happiness is and most definately remains free market capitalism, that puts freedom ahead of "income equality".

4. There's no forerunning economic activity without concise rule of law and maximally-imposed legal system. In fact, only private property ensures that individuals will ever fulfil their dreams, reflected upon the vision they have in mind.

5. State should not be involved in Economy, because Economy is not a matter of "intervention", but a matter of finding yourself, your success and your way to rise to the challenge of tomorrow, lead by an invisible hand.

6. It's morally unacceptable to let "trade union" to be in charge of imposing decisions, that have a negative impact on thousands of others. Going that way, is unacceptable indeed, because trade unions have no explicit right to negotiate about the others. Negotitation about "minimum wages" in the most viably destructive meaning, leads to uncertain future and possible economic devolution.

7. Ask not what your country can do for you, ask not what you can do for your country, but rather ask what you can do for yourself.

8. "Can ever again take for granted, his or her freedom our a precious gift to freedom. That gift to freedom is actually a birth-rise to all humanity and that's why is important to spread the voice of freedom upon the darkest corners of the world, urging leaders to send a new signal of openness to the world, by putting down fearful condemn of government in order to let everyone to be free and participate freely in the market, prosperously contributing a lot to free Economy.

9. There's always a majority and there's always a minority. No matter what could happen, it's impossible for any absolute majority to reject, violate or refuse free entrepreneurial activity in terms of competitive coexistence.

10. At last, but not least. There's always a "laissez-faire" way of solving problems and dealing complex situations. Finally, let us attempt to try to impose a viable underlayment, that free-market Economy was, is and will always be better run that command-driven Economy.

References:

Alexander Marriot: The Limitations of the Marxist Approach to Writing History: David R. Roediger's The Wages of Whiteness, CAPMAG, 2006

Kathy Krajco: The Roots of Antiamericanism

Lee H. Bashing: The Intelecutal Origins of Antiamericanism

Milton Friedman: Free to choose, A personal statement

F.A. Hayek: The Road to Serfdom, University of Chicago Press, 1982

Ljubo Sirc: Yugoslav Economy under Self-Management, Palgrave, 1978

Milton Friedman: Capitalism and Freedom

Adam Smith: The Wealth of Nations

Andrew Bernstein: Global Capitalism, The Solution to World Poverty and Oppression

Andrew Bernstein: The Capitalist Manifesto, University Press of America, 2005

REFLECTING UPON THE HISTORY: TWO DIFFERENT IDEOLOGIES, BUT ONLY ONE GOAL IN COMMON

But when a long train of abuses and usurpations, pursuing invariably the same object, evinces a design to reduce them under absolute despotism, it is their right, it is their duty, to throw off such government, and to provide new guards for their future security.

The Declaration of Independence

The Declaration of Independence