Sunday, July 30, 2006

Saturday, July 29, 2006

AWARDING COURAGE: ESTONIA - A TIGER THAT HAS CREATED ECONOMIC MIRACLE

Laar inherited rapidly grown inflation, 30% unemployment and mostly government-owned businesses which looked like a dirty shamble. Laar's government was the first one to introduce liberal economic reforms and had introduced the following steps to move Estonia out economic disaster:

- The removal of price controls

- Cutting welfare programs

- Cutting regulation

- Rapid and transparent privatization of government-owned businesses

- The introduction of new currency

- Instituting simple and fair flat-rated income tax which has lowered over time and now equals 20%

Results were stunning. The inflation has dropped below 3%, unemployment is now lower than 6% and foreign investment has been pouring in like an avalanche of recovery. Estonia has enjoyed the greatest Economic growth of any of the former Soviet states. State Department has ranked Estonia as the most competitive country of all new member states in the EU.

For his achievements and continuing commitment to personal and economic freedom for Estonia and elsewhere, Laar on May 18 traveled to Chicago to receive the Cato Institute's 2006 Milton Friedman Prize for Advancing Liberty. He is the third recipient of the $500,000 biannual prize, named in honor of brilliant and mastermind American economist Milton Friedman.

Laar served two terms as prime minister. His accomplishments and those of his team of government reformers are particularly remarkable because Laar is not an economist. He is a historian. He read his first Western book on economics--Friedman's Free to Choose--shortly before becoming prime minister. Laar determined to put Friedman's principles of free markets, low and fair taxation, and trust in people into practice.

Steve Stannek has made an interview with the most liberal prime minister in Europe where young and experienced Laar has told how he and his government faced the troubles that were caused as a result of communist oppresion. You read the interview below.

Stanek: I understand the first book on economics you read was Milton Friedman's Free to Choose. How did someone who grew up under Communism come across a book by Milton Friedman?

Laar: First of all, when you grow up in Communism, you know books on economics are not really on economics. They are Communist political propaganda. It is very hard to believe in Karl Marx when you see what is happening around you. Ronald Reagan once said, "What is the difference between a Marxist and an anti-Marxist? A Marxist reads the books of Karl Marx. An anti-Marxist understands them."

The first time I heard the name Milton Friedman, it was in propaganda newsletters that said there is one very bad and very dangerous economist, and his name is Milton Friedman. I was quite sure, when he is so dangerous for the Communists to be telling me this, he must be a good man. Free to Choose was one of the first Western books translated into Estonian at the end of the 1980s. That is how I had the chance to look at these ideas, which, when they were introduced in Estonia, looked quite crazy to many Western people but which to me looked quite logical, I must say.

"

Stanek: We have some debate in the United States about our income tax system and other taxes. If you had a room full of congressmen and senators here, what would you tell them about the flat tax?

Laar: I think nearly all of them know it is a good thing. When you look logically at how the tax works and at the current tax system in the United States, it is very hard to find anyone who is satisfied with it. The problem is, even when the people know the flat tax is a good idea, it looks like the politicians are afraid to do it. This is because they are afraid to lose the wealth; they are afraid to lose the power; they are afraid of the discussion.

It's quite radical reform. There are influential groups in the United States who are against this kind of reform, starting with tax lawyers. This is one group that would be out of a job if you could do your taxes on a postcard. Last year in Estonia, 83 percent of people did their taxes electronically, and it took from five to 20 minutes for each of them. So you don't need tax lawyers or a big tax bureaucracy.

Stanek: Were you surprised at how rapidly Estonia began to improve economically after embracing these ideas?

Laar: I must say we are a little bit surprised, to be very frank, because when we started the reforms, the administration was really very bad. Even as we taught that we would get up and get development, as we started to see development, it was actually more than we expected.

Stanek: Have you been surprised at how many of the other countries in Europe have been embracing the flat tax? I understand eight other countries have a flat tax and others are moving toward it.

Laar: At first everybody was a little cautious to see whether this would work. When it was seen that it worked, they were willing to do it. Our closest neighbors Latvia and Lithuania did it, and then it was some small distance to ask would it work in free countries? And would it be sustainable in the European Union? And when it was seen what was happening [in Estonia, Latvia, and Lithuania], there was the next big wave of tax reform, because it really is a working model. It brings more money to the budget. It supports growth. Its relevance has been proved. It works.

Stanek: What would you say are the greatest benefits Estonia has enjoyed from the transition to a new economy? Are they simply economic, or is it more encompassing, with people feeling better about their lives? Do they feel they have control over themselves and their families that they didn't have before?

Laar: I think to have control over your life and family is a challenge. It will not always make you happy. Nevertheless, it is one of the greatest feelings you can have. Liberty is something that, when it's there, you maybe are not noticing it, but you understand absolutely when you don't have it. We are coming from a society where we did not have it. And this is something which is very important to us. I think the most important thing in our reforms is that we gave the power to the people. We trusted the people. We made them free. That was the goal of the tax reform and our other reforms.

Stanek: Tell me a little about your acceptance of the award. What did you think when you learned you were named to receive the Milton Friedman Prize for Advancing Liberty?

"Liberty is something that, when it's there, you maybe are not noticing it, but you understand absolutely when you don't have it. We are coming from a society where we did not have it. And this is something which is very important to us."

Laar: I was quite positively surprised, because I am not an economist. Getting a prize named after a great economist, a man I admire very much, I am very honored. Of course it is not a prize for me. It is a prize for my countrymen and country, because the government's task is only to make the conditions. The people are the ones who are doing the miracles.

Suggested further readings:

Mart Laar: What have we learned in Estonia about Freedom and Growth

Heidi Brown: The Baltics: Pampering Foreign Investors, Forbes

Madsen Pirie: Estonia's Success

Mart Laar: Walking on Water: How to do it, Brussels Journal

Mart Laar: Just do it!

Saturday, July 22, 2006

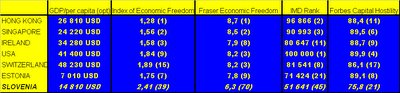

TAX POLICY FOR PROSPERITY: WHY IS THE FLAT TAX GOOD FOR SLOVENIA?

Streaming to the future, flat tax is inevitable for Slovenia if this country once wants to be the most competitive "Central European Tiger" with impressive economic growth, rapid job creation and highly protective system of private property. To maximize its economic growth, create jobs, raise incomes, and provide the government with sufficient revenue to finance the essential limited tasks of government Slovenia must sooner or later move forward towards simplified and non-discriminatory system of flat tax. Several examples in Eastern Europe have shown that the system of flat tax works perfectly well, since there are no double taxation laws, dividends taxations and where citizens of certain country are not forced to spend their entire time on filling out tax return for months. Instead, they would fill-out the tax return on a small postcard-sized form in matter of minutes.

Today Slovenia faces an immensely exposed challenge. One of its long-term objectives must be to devise a tax system that will help boost economic growth and total factor productivity so the Slovenians will easily overcome their inherited crippling legacy of socialist mismanagement which has moved Slovenia away from prosperity and benefits of free market economy. However, the new tax system must be made attractive to foreign investors. This is being extremely important because of integral globalization which awards nations with low tax-rates and non-discriminatory environment for foreign investment. Essentially, foreign investment is one of the foremost drivers of economic growth. Yet, the tax system in Slovenia needs flat tax. It must raise its revenue to finance the needs of hopefully limited government with rare spending habits. The flat tax is a good solution for Slovenia to become prosperous, competitive and successful small tiger in the heart of Europe.

Nearly every economic theorist and expert for public finance prefers flat tax. It holds low tax rates where people have a strong incentive to work and a little reason to hide their money from the government. After getting rid of many specific forms of taxation, flat tax does not impose bias against saving and investment. It also completely eliminates all forms of different tax treatment, preferences and penalties so that consumers' decisions are based on economic merit rather than on tax consideration. In case of certain fundamental or incremental tax reform, Slovenian leaders will face a never-ending number of obstacles towards implementing the flat tax. Unfortunately, international bureaucracies are very likely to be a part of that problem. The EU and OECD, for instance, strongly represent interests of high-tax nations, such as Germany and France. Those and many others area of extreme and discriminatory taxations have already been very upset that some Eastern European nations are moving ahead and implement the flat tax. The bureaucrats apparently don’t understand that higher tax rates simultaneously discourage work, saving, and investment and encourage tax evasion and tax avoidance.

The IMF may be even more dangerous than the OECD and EU since it uses its large budget to bribe nations to follow its advice. Slovenian leaders should reject the bad advises of international bureaucracies immediately. There's no other choice if Slovenia really wants to become a bite-roaring economic tiger or "Singapore of Central Europe". If tax rates will remain too high, people will keep hiding the money away from the government. Even worse, foreign investors will rather choose another country to build production factories and create jobs. Indeed, this is why it is so important to be radical and reject harmfully bad advises of international bureaucrats from EU and OECD against tax competition.

If Slovenia doesn't lower tax rates and reform its rigid tax system, it will have very little chance of successfully competing with other nations in the region that have made these changes. Foreign investors will have plenty of options left to choose where to build high-tech production parks. They will rather choose Slovakia with 19% corporate tax, Romania with 15% corporate tax rate. Why should Nokia build a factory in Slovenia, when it can benefit from Hungary's 16% flat rate on corporate income. Simply told, Slovenia must compete or perish.

It must become a leading innovation free market nation and create competitive, free and friendly investors' business environment like no other nation before. Continually, it must improve its score on regulation, banking system, pension reform, labor market flexibility and private property rights in order to climb to the top. And if the IMF (or even the World Bank) argues that tax reform and tax rate reductions will deprive the government of too much revenue, Slovenia's leaders should point to what has happened in other nations. In Russia, for instance, income tax revenues have nearly doubled since President Putin shifted from a 30 percent “progressive” tax to a 13 percent flat tax. Estonia rejected IMF's advice to implement strongly progressive tax system back in 1994 and had moved towards the flat tax. The results of implementing it were of course impressive. Other Eastern European nations have seen similar results because of faster growth and less evasion. More than 40 years ago, American president John Fitzgerald Kennedy implemented congratulating reductions in tax rates. His opponents made the same arguments as the ones we hear from international bureaucratic monsters such as EU and OECD today. But President Kennedy had a vision and preserved. He told critics that:

"Our true choice is not between tax reduction, on the one hand, and the avoidance of large Federal deficits on the other. It is increasingly clear that no matter what party is in power, so long as our national security needs keep rising, an economy hampered by restrictive tax rates will never produce enough revenues to balance our budget just as it will never produce enough jobs or enough profits… In short, it is a paradoxical truth that tax rates are too high today and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now."

Slovenia should follow this highly sensible advice. American economy boomed after Kennedy's tax cuts in the 1960s and it sky-rocketed again when Ronald Reagan cut corporate and personal income tax rates in the 1980s. Slovenia should do the same. If enacted, let Slovenia cut its extremely high tax rates and let it reform the tax system. I hope that Slovenian policymakers will not listen to bureaucratic monsters who represent crippling, backward and damaging thinking of high-tax welfare states such as France, Germany, Sweden, Italy etc. Slovenian lawmakers should eliminate the evil called progressive taxation and finally implement the flat tax in order to let its economy moving upward with high rates of economic growth, rapid job creation, privatized economy, strong protection of property rights and new way of thinking how to become the most competitive small tiger in the global economy.

Like Estonia, Slovenia should champion private property rights through privatization and pursue tax competition via flat tax.

Taking amazing geographical location, privatization launch, competitive strength and free trade into account, Slovenia has excellent potential for being the tiger of hope, the child of brave and the champion of economic freedom.

Friday, July 21, 2006

YEGOR GAIDAR AND THE INSTITUTE FOR ECONOMY IN TRANSITION

Recommended readings:

Alvin Rabushka: Russian Economy Archive

Thursday, July 20, 2006

STEVE FORBES: FLAT-TAX REVOLUTION. USING A POSTCARD TO ABOLISH THE IRS

Forbes's masterpiece is a significant work with a lot of helpfully served information. I think everyone who's worried about the future of tax codes should simply read this book.

Flat Tax represents an idea of restoring liberty upon equality. The people who prefer progressive taxes actually prove themselves to be dedicated to the main idea pinned down in Communist Manifesto written by Marx and Engles. They entitled progressive taxation as the basic idea of communist society. There's a never-ending list of "yes" for the adoption of a single, competitive and fair flat tax. The main reasons are growth and simplicity. Economically, the argument of simplicity works perfectly since the margin of administrative costs falls down respectively. In fact, taxes are the main determinant of variability in productive behavior. Higher taxes mean less capital inflows which could be translated into high drop-out rate of new jobs. In fact, policymakers in socialist countries such as Sweden, France, Germany, Slovenia and Italy strongly underpin their uprising for "poor". Bullshit. Do you know that current economic growth in China pulls a million people from poverty a month? Do you know that Slovakia, after adopting the flat tax in 2004, almost trippled its GDP compared to its situation in 1993 when the country launched institutional restructuring towards market economy and property right protection. Do you know that Estonia after adopting a single marginal flat tax rate has been constantly considered "economically completely free" country? Estonia's remarkable achievement of transition was its shifting towards free market economy. Once the "sick edge of Baltics" is now, according to State Department, one of the most competitive countries in European Union in terms of efficiency and performance. Do you know that Hong Kong has been serially treated as No.1 place of economic freedom? The main ingredient of this success was definitely its flat tax system that boosted productive behavior and invited investors from all around the world to invest in Hong Kong. Another reason for simple and effective flat tax is the security of our financial resources. Privatizing social security and health care is just one chapter of this competitive potential. State-subsidized welfare programs of health care and social security are nothing else but a "big joke" that cheats millions of taxpayers who don't receive a credible commitment that their money contributed to the "national health care scheme" will be spent rationally and effectively. Shifting towards private accounts for social security would definitely turn out in an increase of wealth since yields of market investment funds raise impressively. This would result in a free choice of selecting where to put your money in order to be returned in higher value respectively. And finally, tax returns would be filled out on a simple postcard-sized paper. This would mean that you will no longer have to rent tax advisers and tax specialists. The only you'll have to do is to fill out a simple form in a matter of minutes. As simple as that!

If you want to hear more about flat tax than read Forbes's Masterpiece. Click here or here.

DEMS AND BLACKS

Democrats or Republicans?

Read Thomas Sowell's column from the latest edition of Townhall

here and find the answer.

But here're some of definitely the most undeniable facts:

1. Most blacks are working people and taxpayers

who do not benefit from welfare programs of from affirmative actions.

2. Blacks are more likely to gain from vouchers pulling them out of the trash called

"public schools". Vouchers would provide them a decent education in a decent place.

3. Gun control makes no sense. In the most criminal neighborhoods, criminal have access to nearly every piece of the most dangerous weapon.

Gun control would pull the potential victims in a very negative position by preventing them from being unable to defend themselves and stand against criminals.

Incidentally, most uses of guns in self-defense do not even involve pulling the trigger.

Once you pull a gun on someone who is threatening to assault you, he is likely to have a very sudden change of plans and head elsewhere.

In communities where most people are known to have guns in their homes, burglaries are rare and violent crime rates are low.

Guns deter as well as defend.The laws of gun control do not actually control guns but protect the criminals respectively.

4. Perhaps even more bizzare ideas is hidden in the thing called "social engineering programs" namely used in Scandinavia (Sweden) and other empires of socialism, including Slovenia. The programs are claiming to be about "drug prevention" or "decision-making" or some other innocuous-sounding name. The idea is that each child should make up his own morality. A more stupid or more dangerous idea could not have taken root anywhere but in a school of education.

5. Self-Defence is a human right and let it be treated that way.

6. Let me cite the words once said by a man "wisdom-of-the-mind" Ronald Reagan: "Government is not the solution to the problem, government is the problem". Finally, Democrats are not the solution to the problem, they are the core of the problem itself.

Wednesday, July 19, 2006

Monday, July 17, 2006

INFORMATION TECHNOLOGY AND GROWTH

DR. LJUBO SIRC: THE ESSENTIAL QUESTION IS HOW TO INVIGORATE SPONTANEOUS ENTREPRENEURSHIP"

"Of course trade unions claim higher wages, but the only way to get them is to work productively. Instead of doing everything possible to improve our productivity, which would be resulted in higher wages, trade unions insist on a deadline without imposing any credible changes . And there's no growth without changes because growth itself requires flexibility. Rapid growth and productivity result wealthier quantity of production goods. If the quantity is too high, then a portion of production factors needs to be replaced into other production. Thereby we say that the elasticity of demand is too low. The onward consequence is that not everyone can be guaranteed for having the same job in the same area of experty ever after."

Ljubo Sirc, PhD

Wednesday, July 05, 2006

THE MARGARET THATCHER CENTER FOR FREEDOM

The MTCF contains numerous papers concerning the future of Anglo-American relationship in terms of cooperation and leadership in the world dedicated to advancing the vision and ideals of Lady Thatcher.

Click here or the picture above in order to access to the website.

Disclaimer: The Margaret Thatcher Center for Freedom was instituted by Heritage Foundation

Tuesday, July 04, 2006

THE 4th OF JULY - CONGRATULATIONS AMERICANS!

--The Declaration of Independence

"We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty, and the pursuit of Happiness.—That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed,—That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness. Prudence, indeed, will dictate that Governments long established should not be changed for light and transient causes; and accordingly all experience hath shown, that mankind are more disposed to suffer, while evils are sufferable, than to right themselves by abolishing the forms to which they are accustomed."

-- The Declaration of Independence

The "Top 7" collection of inseparable bits of wisdom and assorted remarks related to American Founding Fathers

"Each individual of the society has a right to be protected by it in the enjoyment of his life, liberty, and property, according to standing laws. He is obliged, consequently, to contribute his share to the expense of this protection; and to give his personal service, or an equivalent, when necessary. But no part of the property of any individual can, with justice, be taken from him, or applied to public uses, without his own consent, or that of the representative body of the people. In fine, the people of this commonwealth are not controllable by any other laws than those to which their constitutional representative body have given their consent.

John Adams

"I am for doing good to the poor, but I differ in opinion of the means. I think the best way of doing good to the poor, is not making them easy in poverty, but leading or driving them out of it. In my youth I traveled much, and I observed in different countries, that the more public provisions were made for the poor, the less they provided for themselves, and of course became poorer. And, on the contrary, the less was done for them, the more they did for themselves, and became richer.

Benjamin Franklin, On the Price of Corn and Management of the Poor, November 1766

"Experience is the oracle of truth; and where its responses are unequivocal, they ought to be conclusive and sacred."

Alexander Hamilton, Federalist No. 20, December 11, 1787

"Men of energy of character must have enemies; because there are two sides to every question, and taking one with decision, and acting on it with effect, those who take the other will of course be hostile in proportion as they feel that effect.

Thomas Jefferson, December 21, 1817

"As the cool and deliberate sense of the community ought in all governments, and actually will in all free governments ultimately prevail over the views of its rulers; so there are particular moments in public affairs, when the people stimulated by some irregular passion, or some illicit advantage, or misled by the artful misrepresentations of interested men, may call for measures which they themselves will afterwards be the most ready to lament and condemn. In these critical moments, how salutary will be the interference of some temperate and respectable body of citizens, in order to check the misguided career, and to suspend the blow mediated by the people against themselves, until reason, justice and truth, can regain their authority over the public mind?

James Madison, Federalist No. 63, 1788

"This new world hath been the asylum for the persecuted lovers of civil and religious liberty from every part of Europe. Hither have they fled, not from the tender embraces of the mother, but from the cruelty of the monster; and it is so far true of England, that the same tyranny which drove the first emigrants from home, pursues their descendants still. Tyranny, like hell, is not easily conquered; yet we have this consolation with us, that the harder the conflict, the more glorious the triumph."

Thomas Paine, Common Sense, 1776

"The value of liberty was thus enhanced in our estimation by the difficulty of its attainment, and the worth of characters appreciated by the trial of adversity.

George Washington, letter to the people of South Carolina, Circa 1790

Monday, July 03, 2006

STAND UP FOR THE CHAMPIONS: A GLOBALIST MANIFESTO FOR PUBLIC POLICY

Charles W. Calomiris from American Enterprise Institute in his latest book A Globalist Manifesto for Public Policy offers brief but astonishing analysis about how the empirical examination of marvellous trends of globalization substantially contributes to substantial economic benefits that build a bridge of enhencement to prosperity, free society and unparralled economic growth.

Charles W. Calomiris is the Arthur F. Burns Scholar in Economics at American Enterprise Institute

Sunday, July 02, 2006

JUST A SMALL NOTICE

Saturday, July 01, 2006

MILTON FRIEDMAN: INFLATION AND UNEMPLOYMENT

"Government policy about inflation and unemployment has been at the center

of political controversy. Ideological war has raged over these matters. Yet the

drastic change that has occurred in economic theory has not been a result of

ideological warfare. It has not resulted from divergent political beliefs or aims

It has responded almost entirely to the force of events: brute experience

proved far more potent than the strongest of political or ideological preferences..."

--Milton Friedman