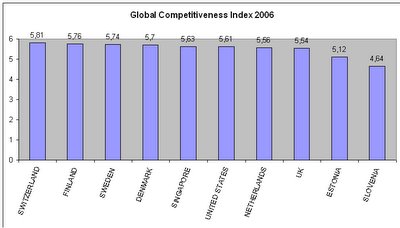

This year's Global Competitiveness Index surprised many economists, managers, researchers, scholars and other people as well. Two years ago nobody could think of Swiss economic tiger on top of the Global Competitiveness Index issued by World Economic Forum.

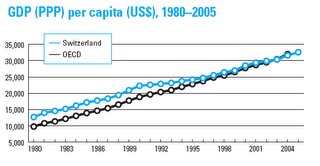

Switzerland is truly the embodiment of the success story. The country has preserved its political neutrality for a long time. Aided by peace and neutrality Switzerland had almost no problems in facing challenges in the global economy. The country's institutional order is very sufficient in terms of protecting everyone's wealth and income when he enters the market. Milton Friedman, Gary Becker and Douglass North have defined solid protection of private property rights as a key element of the economic freedom. Heritage Foundation's Index of Economic Freedom firmly placed Switzerland among the freest economies in the world. Long years of stable politics and stable currency, relatively low taxes, secure financial system and many incentives for incoming investors have made Switzerland an attractive investment destination especially for small manufacturing firms. Larger businesses are internationally highly competitive while agricultural businesses are small and economic policy has insisted on largely protecting them from foriegn competition.

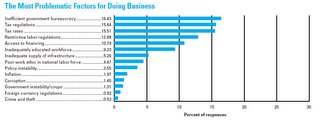

Despite of brilliant innovation performance, Swiss consensus-driven business and political system retard further economic growth. Similar distorsions could be seen in Germany, Italy, Austria and Slovenia. Several years ago, Switzerland has announced its intention to pursue free trade agreement with the United States. We hope that this comes true. Switzerland favors a moderate trade policy, far from being a protectionalist economy. Only restrictive agricultural trade policy is varying aside from this. Nearly all agricultural products are subject to strict import duties and variable quotas. Protectionist agricultural trade policy lowers the level of Swiss economic globalization. Relatively low taxes are an important aspect of producing incentives to acelerate more productive behavior and efforts in order to work, save and invest. Current top cantonal income tax rates is 35% while top cantonal corporate tax rate is equal to 23%.

A little bit worrying is unusually high public expediture rate (36% of the GDP) setup by the government. Bernanke, Mishkin, Laubach and Posen (1999) report that Switzerland adopted inflation targeting in December 1974. The desire of the monetary policy was to coordinate the inflation expectations of the public with policy objectives of the central banks. Monetary targeting has been quite flexible in practice. Switzerland announced a point target which arguably doesn't give the public the false impression that money is controllable over a narrow range. At the beginning og 1975 Switzerland was about to enter the worst recession in postwar history. The oil shock had triggered a downturn that must already have been under way. Although the Swiss franc helped to absorb the inflationary impact of the shock, that impact posed a serious threat to the Swiss export sector, which constituted about a third of GNP at the time. During 1975 exports of merchandise fell by 8% in real terms. Moreover, though subdued growth in real wages supported the Bank's fight against acelerated inflation, it also contributed to a sharp decline in real consumption which was worsened by a significant outflow of foreign workers. The money-targeting initiative did nothing to ease the high costs of Switzerland's disinflatio, nor did the Bank suggest that the targeting would provide a coordinating function for wage- and price-setters that would lower that cost. The adoption of a target was intended to cap inflation expectations by indicating a policy commitment and nothing else. Today Switzerland's annual rate of inflation from 1995-2004 is 0,77 percent.

Institutionally, Switzerland may be one of the best protectors of private property rights due to secure contratual agreements and high quality judiciary. According to World Bank, it takes 22 procedures, 215 days to enforce contracts on the whole. The cost of enforcing contracts is 11 percent of the debt which ranks Switzerland on the 9th place according to the flexibility of enforcing contracts. Switzerland is very open to foreign investment with some restrictions on ownership participation in certain sectors as well. Banking system is secure and offers a wide variety of financial products. Approving credits and loans is allocated on market terms. Aside from extensive regulation practices, informal business sector participation rate is among the lowest in the world according to Transparency International.

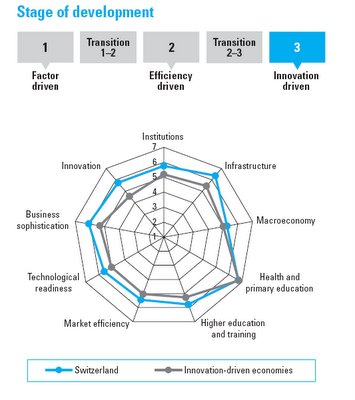

Components that led Switzerland to the top of Global Competitiveness Index were performed successfully. Infrastructure is one of the most sophisticated in the world. It presents one of the foremost requirements for good conditions in order to pursue economic growth and long-term economic development. Macroeconomic picture is a little bit off the anchor but macroeconomic forecasts for the future predict improvement in that way. Higher Education and training institutions offer excellent education opportunities while the cooperation between universities and economy returns profitably and produces excellent output in terms of knowledgeable achivements. Market efficiency and efficiency enhancers successfully derive the problem of business sophistication, as well as of technological readiness.

Other countries showed randomly mixed performance. Traditionally competitive Nordic economies scored very well. Sweden and Finland topped right behind Switzerland. The main drivers of Nordic formula for success are a very sound financial system, strong protection of private property rights, quickly enforced contracts, high R&D expeditures, excellent education system, technological readiness and above-averaged rate of market efficiency and other efficiency enhancers.

Read more:

WEF, Global Competitiveness Index 2006,

Forbes, Global Competitiveness Rankings,

Forbes, The World's Most Competitive Countries 2006,

International Investing Guide