Moody's Sovereign Misery Index

Source: FT Alphaville (link)

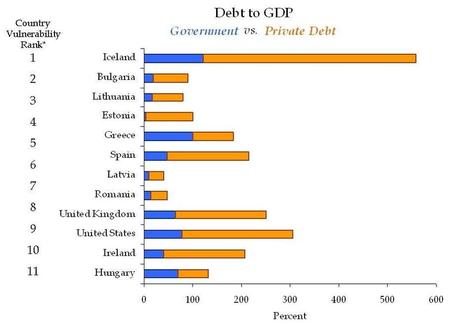

Debt-to-GDP ratio in selected countries

Source: Market Oracle (link)

Source: Market Oracle (link)Spain topped the Moody's Misery Index due to the highest estimated unemployment rate for 2010 and a whopping fiscal deficit. Where's the trouble? As I wrote earlier (link), prior to the outbreak of financial crisis, Spain had a favorable fiscal outlook in 2006 and 2007 and an unfavorable current account balance . In 2007, Spain experienced a 10 percent of the GDP current account deficit largely due to net capital inflows from surplus countries such as Germany and Netherands. These net capital inflows further inflated asset prices, causing an outburst of asset bubble. In the mean time, asset price inflation escalated and real estate price index soared. Government's remaining choice was to push for a fiscal surplus to avoid the inflationary shocks. When the bubble turned into burst, the shortage of external demand (in spite of favorable domestic consumption rate) caused the economy's overcapacity and a deeply negative output gap. In 2008, Spain's economy overheated and the output gap increased to historic highs (3.06 percent of potential GDP). In 2010, the estimated output gap is -2.12 percent of potential GDP. Due to weak aggregate demand - especially weak investment and external demand - asset and consumer prices are decreasing. As firms are reluctant to hire new labor, the result is high rate of unemployment, deflationary pressure and non-existent GDP growth. The macroeconomic situation in Spain pretty much reflects the general macro outlook for the entire Eurozone.

If the ECB decided to raise interest rates significantly, it would further depress an already weak investment activity. If ECB's interest rates decreased further, there would be a serious danger of deflationary trap which dragged the Japanese economy into a decade long period of deflation rates, zero-bound interest rates and stagnant economic recovery. As European population is aging rapidly (as in Japan and other industrialized nations), the outlook for the European economic recovery is rather timid.

Rapidly rising fiscal deficit (link) and public debt is a permanent threat to the stability of the Euro. Of course, the best possible cure to decrease the debt-to-GDP ratio is higher economic growth and also higher rate of inflation which decreases the stock of public debt through higher price level. Europe's real macroeconomic disease is not just low productivity growth and high tax burden but also very asymmetric economic policies. While the ECB sets interest rates for the entire Eurozone, Euroarea countries set independent fiscal policies. In addition, the appreciation of the euro hinders currency swaps into high-yield currencies. That could enable covered interest parity and the reinvestment of foreign currency back into Euro when its appreciation trend would reverse.

Asymmetric fiscal policies are likely to cause significant public debt concern if fiscal policies are discretionary. Prior to the emergence of economic crisis, half of the European countries ran discretionary deficit-financed fiscal policies. If European countries ran prudent fiscal policy based on low government spending and balanced budget, the asymmetric fiscal shocks weren't a major problem at all. However, strong public sector, high government spending and the lack of rule-based fiscal policies pose a significant concern for the stability of the Euro.

What I propose, is not the harmonization of fiscal policy but a strong committment of European countries to limit the scope of discretion in fiscal policy. Each country should forge a prudent fiscal policy without high fiscal deficit. In addition, countries should set a medium-term perspective of public debt reduction. That would ease the problem of asymmetric shocks during economic downturns and enhance the prospects of European single currency. In addition, European countries should rigorously liberalize labor markets. The liberalization of the labor market would remove the unneccesary wage adjustment rigidities. When wages are rigid downward - especially during the recession - higher wages exacerbate a significant pressure on unemployment. And when unemployment rate is high, the demand for discretionary fiscal policy and deficit spending is very high as well.

Without the necessary liberalization of labor market and the pursuit of prudent fiscal policies, the future of Euro and the prospects of the Eurozone are not bright at all.

2 comments:

Your blog is incredible! There much I can learn here; your level of analysis and site development shows me that I need to improve my own blog-site. I am curious which university you attend?

Thanks for your kind remarks regarding my blog. I'm glad you like it and I strive to improve the content, features and highlights of my blog.

I study macroeconomics and international economics at the University in Ljubljana in Slovenia and spend most of my time on studies, readings and research. And which university do you attend?

Post a Comment